Unlocking the Financial Strategies of DeFiLlama: A Deep Dive into Wallet Holdings and Opportunities

In today's discussion, we turn our focus to DeFiLlama, a brand that has garnered much affection and trust within the cryptocurrency sector. DeFiLlama's financial inflow stems primarily from donations, APIs, and grants.

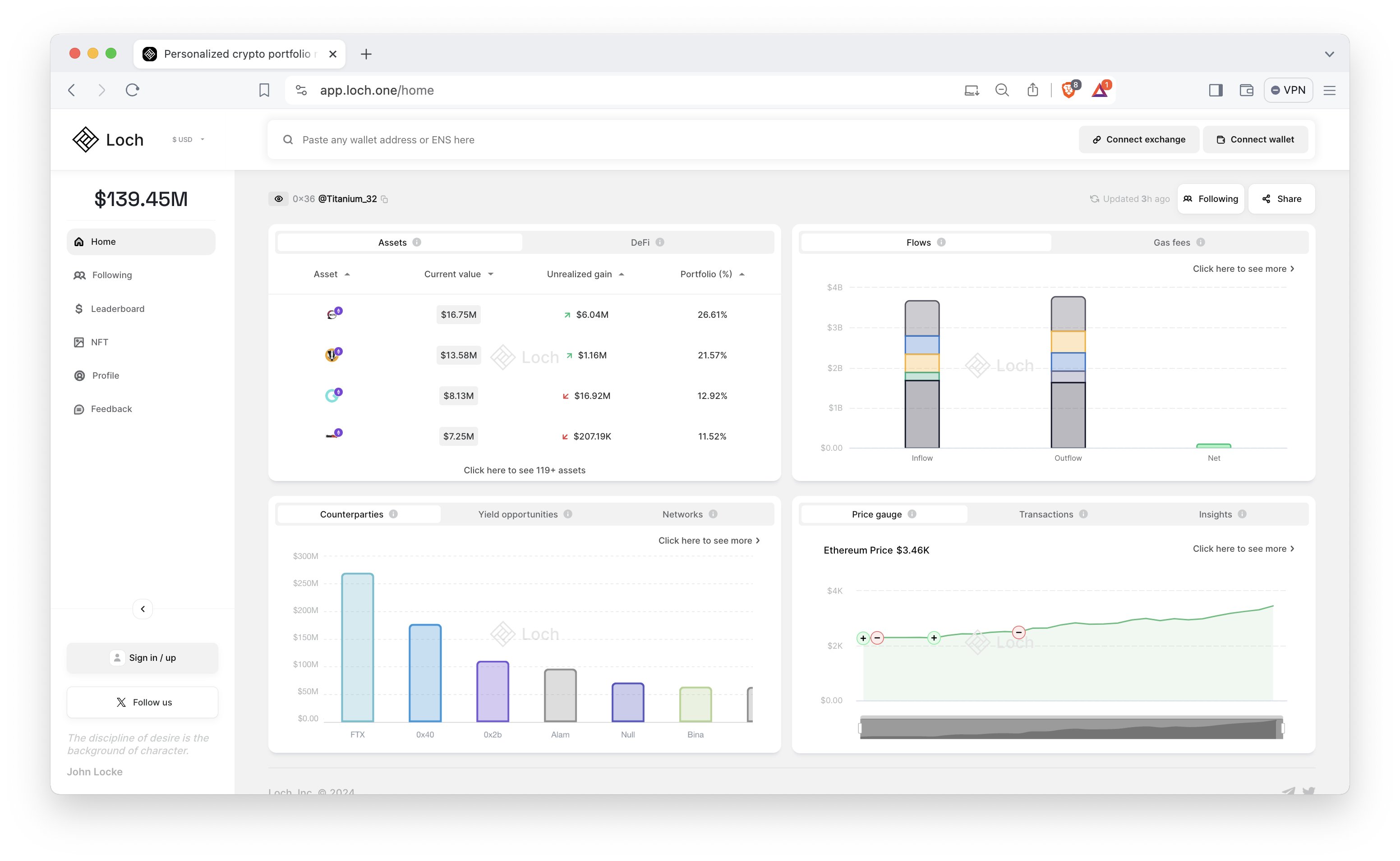

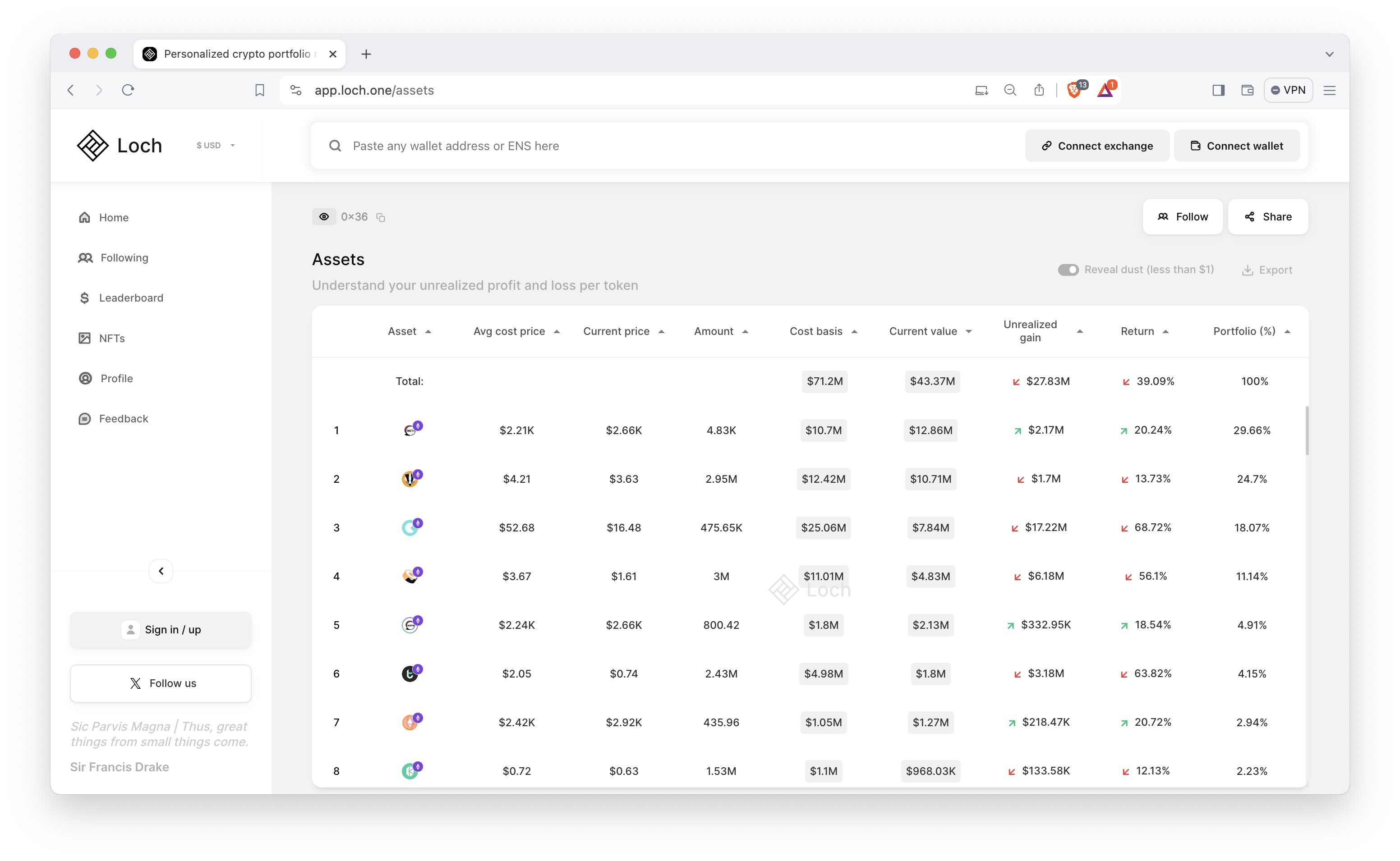

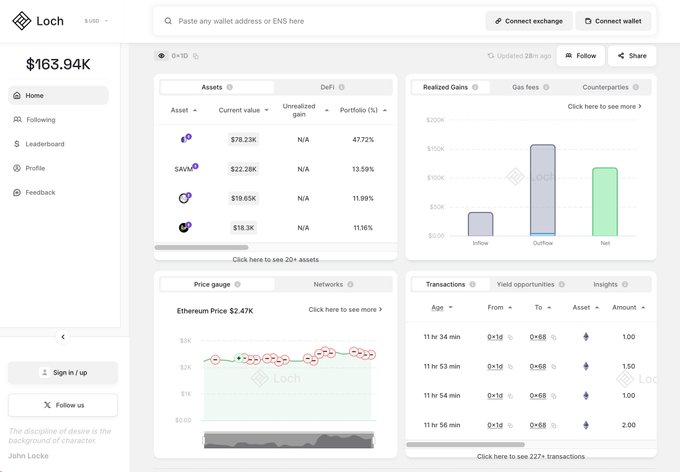

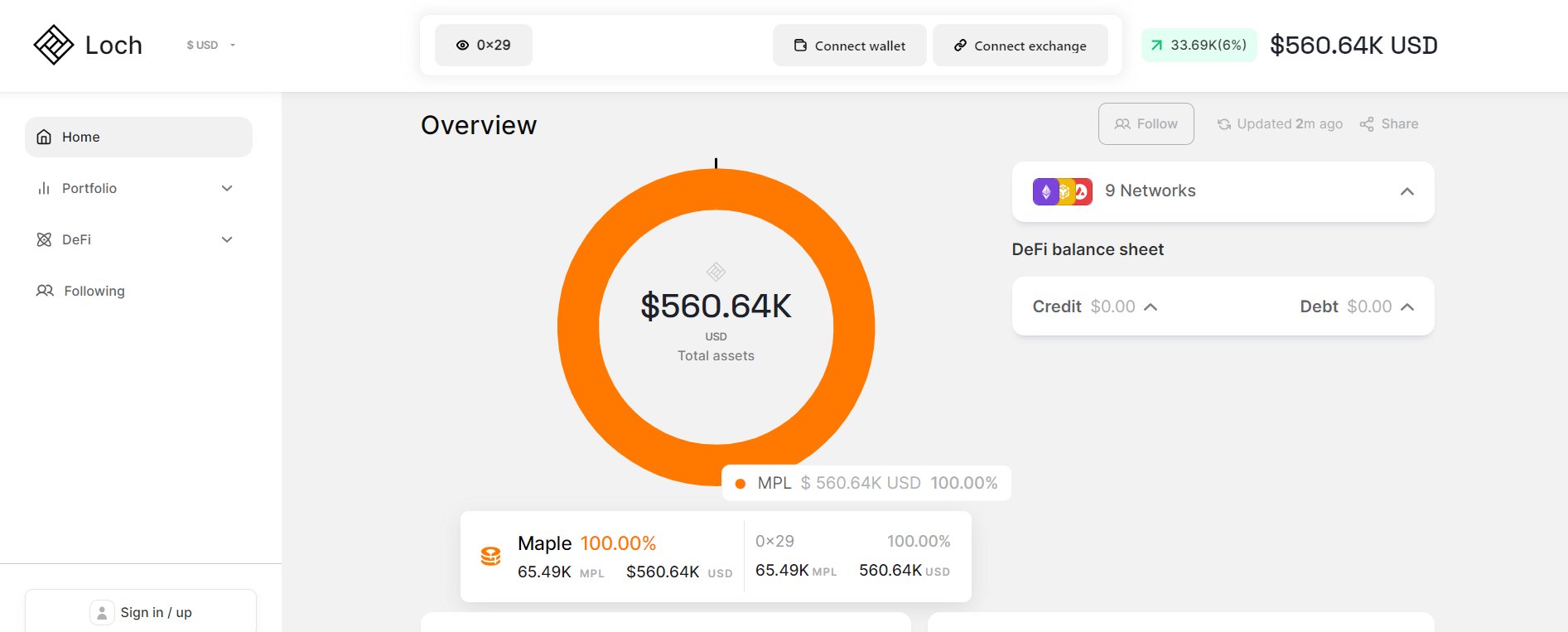

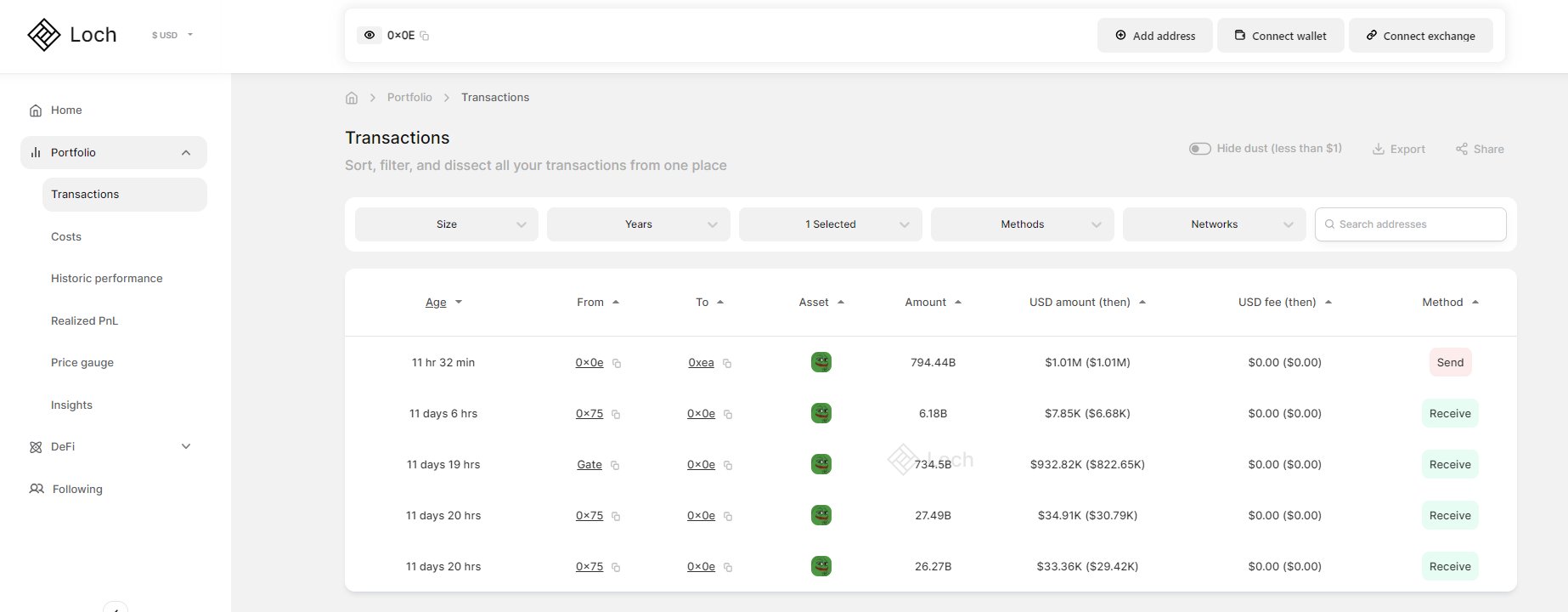

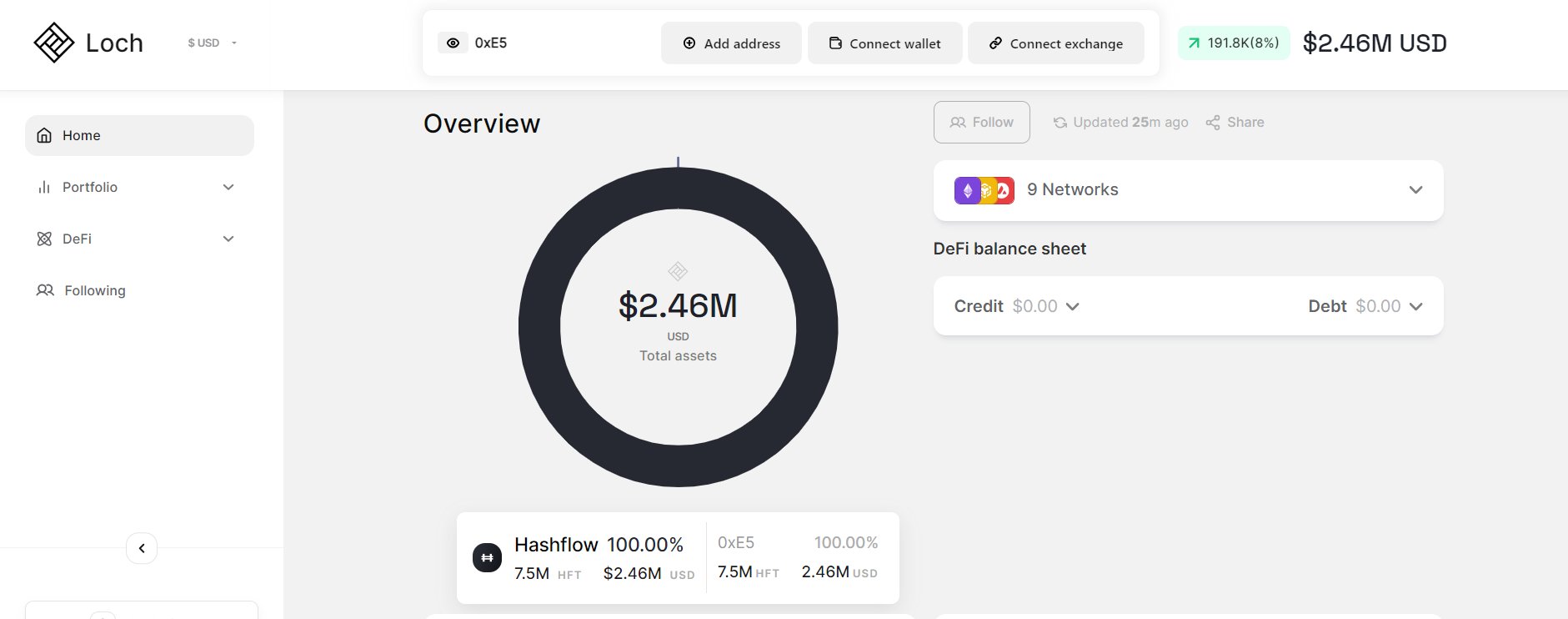

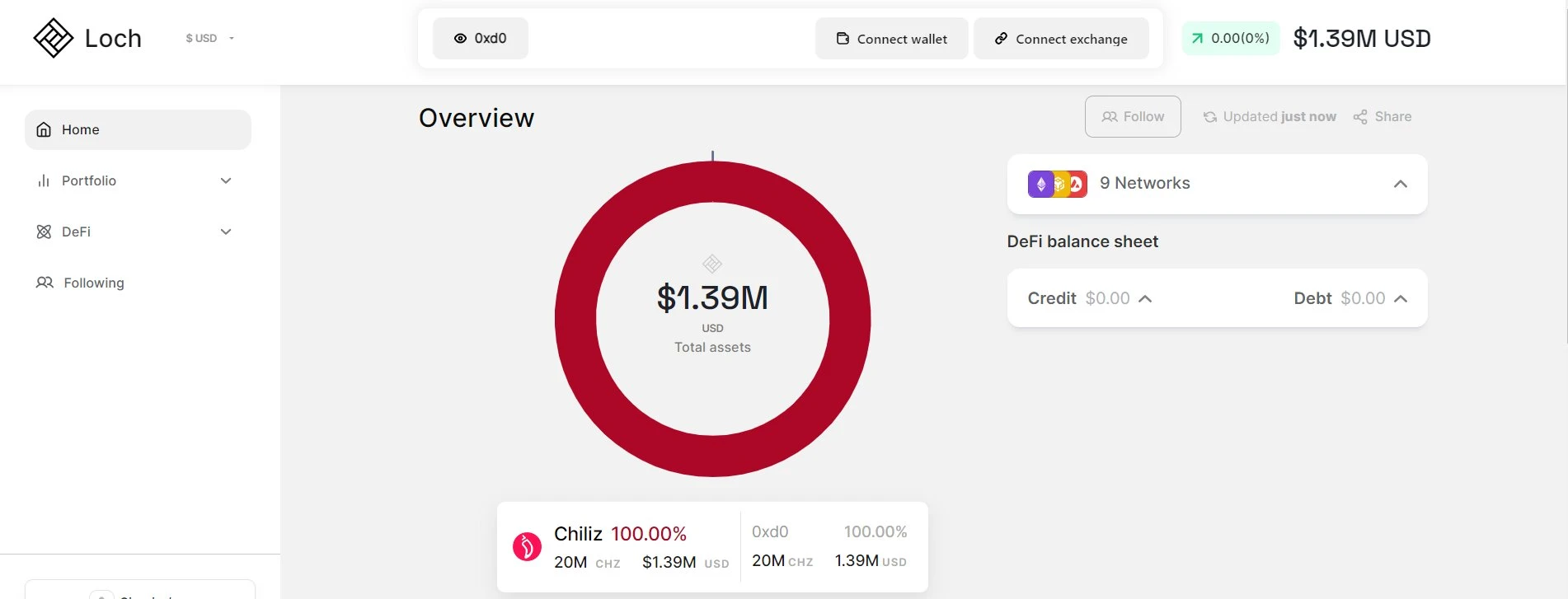

We have managed to unearth one of the public wallets of DeFiLlama to gain more insight into their financial strategies and holdings. The wallet we explored holds a well-diversified and robust portfolio amounting to a total of $252k, including significant holdings in ETH and various stablecoins, a fact that no doubt facilitates the payment processes to DeFiLlama contributors.

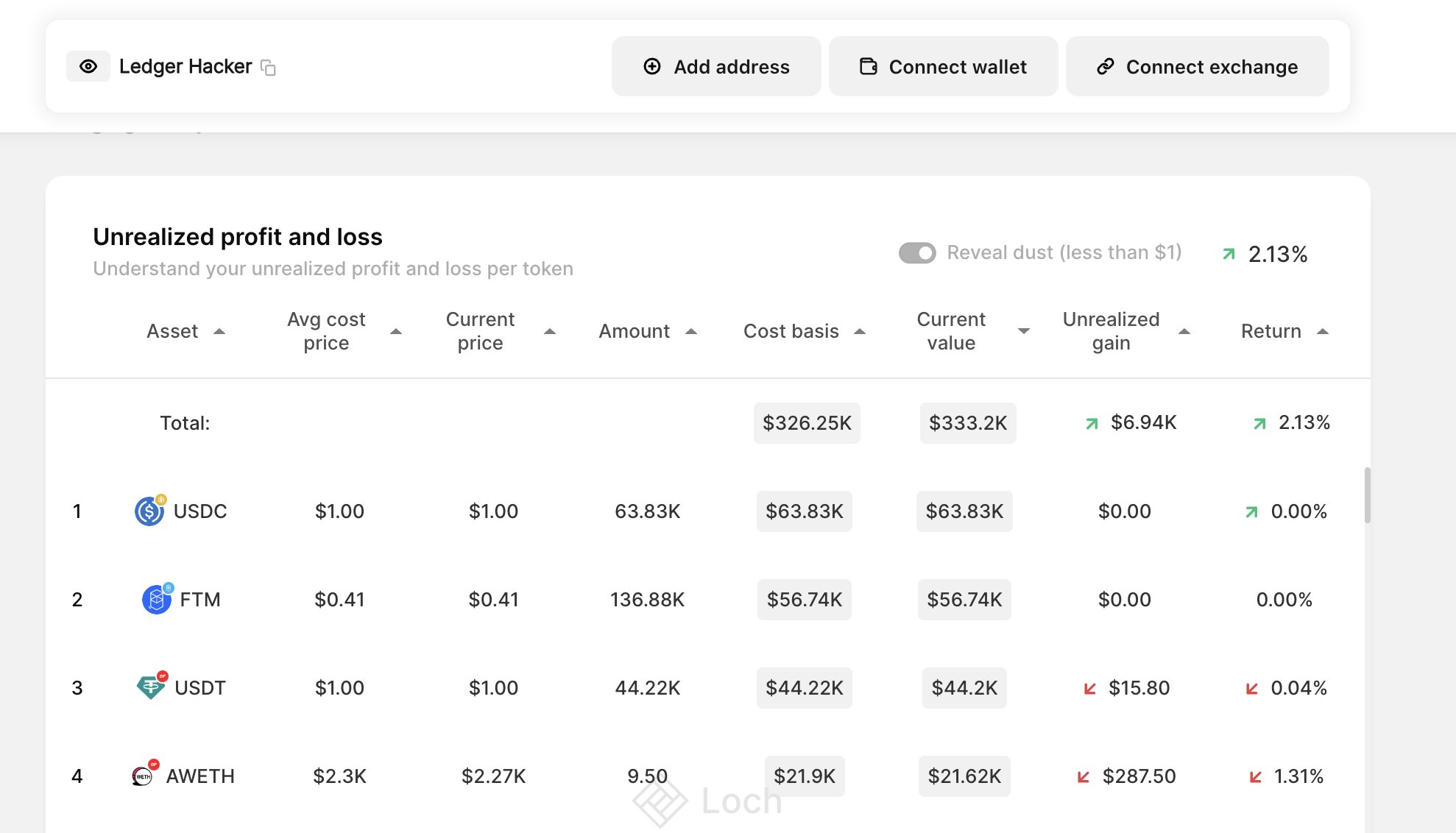

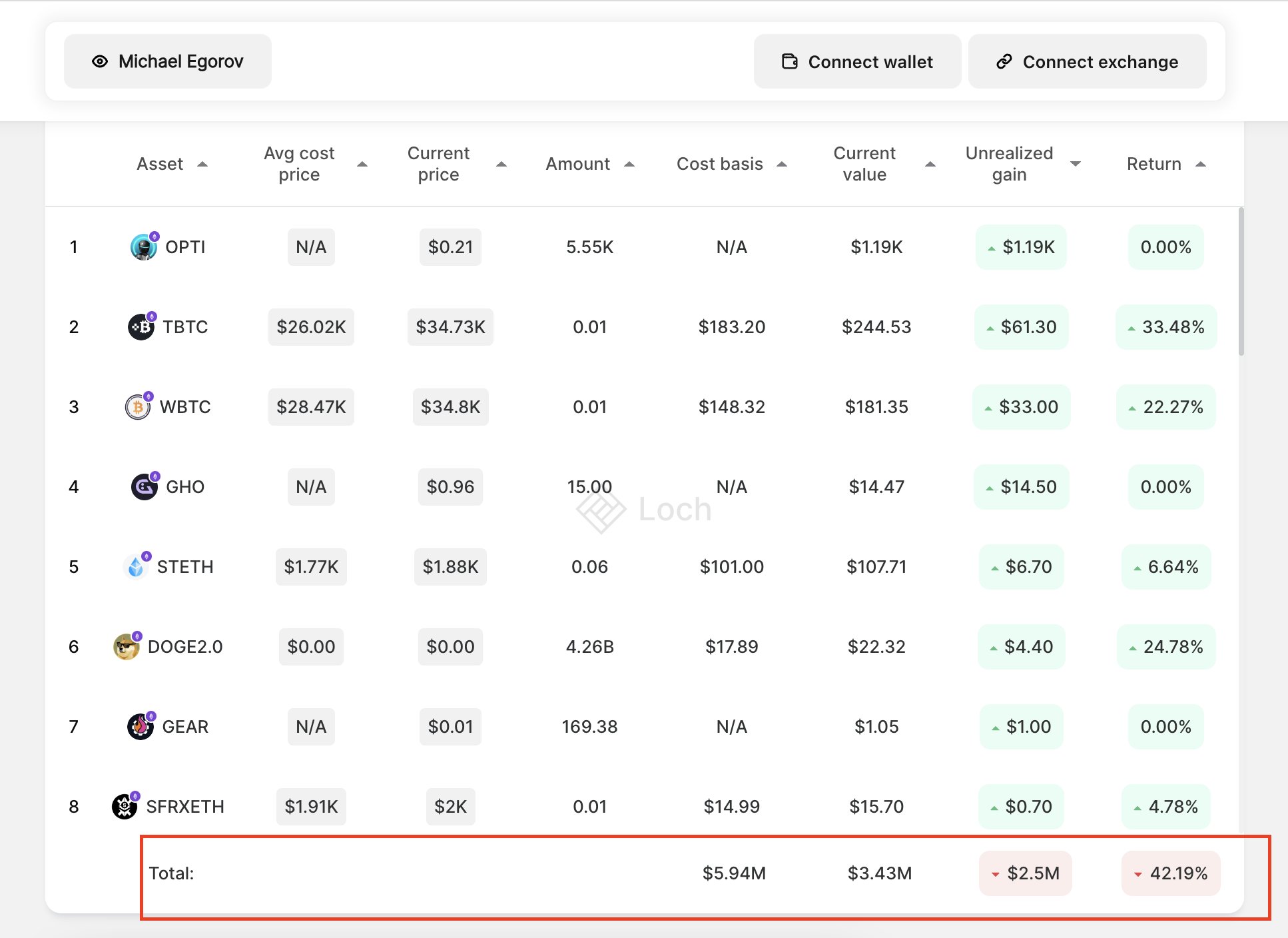

In examining the Current Spot Holdings, we observed:

- ETH: $114k

- DAI: $42k

- WETH: $29k

- USDT: $22k

- USDC: $13k

- Others: $32k

When evaluating the Cost Basis and Unrealized Gains of this wallet, it’s apparent that most holdings are either at breakeven or experiencing a loss, and there’s no active management or trading conducted with this particular wallet. Notably, the ETH holdings are approximately 16% down, showing an average price of $1898, compared to the current market price of $1593 as of September 28.

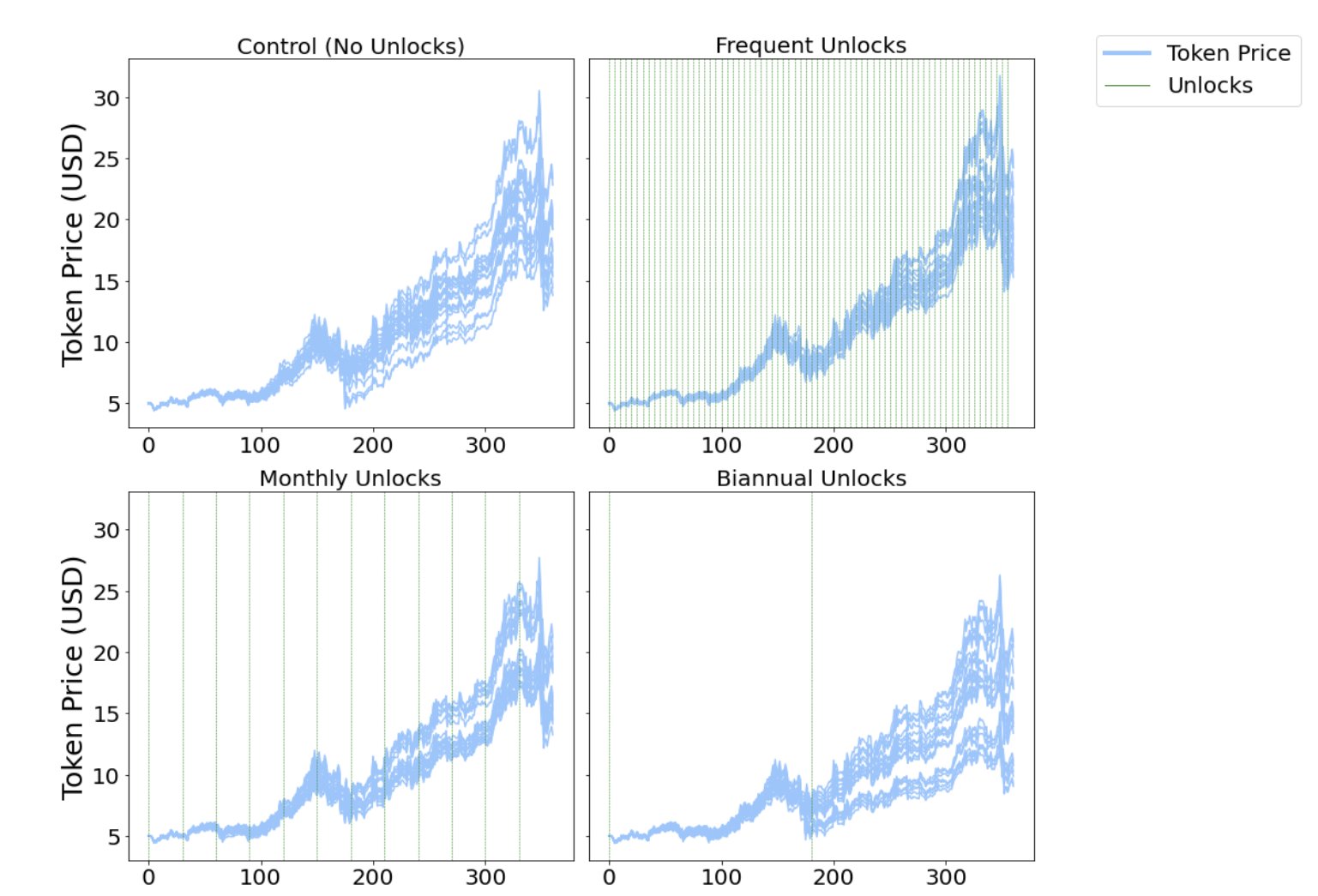

Shifting focus to Net Flows and Realized Gains, we unearthed some fascinating details. DeFiLlama’s wallet enjoys a 37% lifetime profit margin, with a significant proportion of these profits attributed to the $OP token. This profitable stance likely results from a grant DeFiLlama received the previous year from Optimism's RPGF program. Without this grant, their financial flows would have been in the negative.

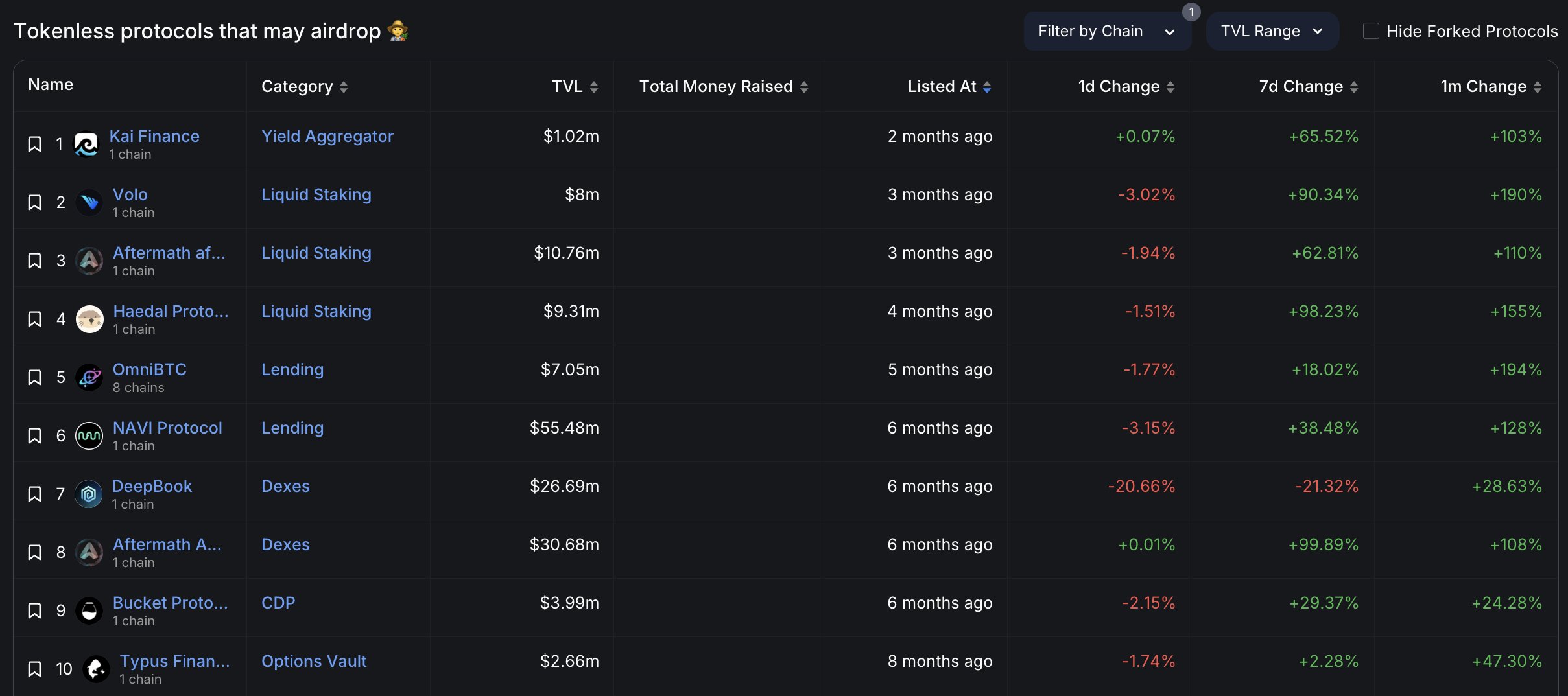

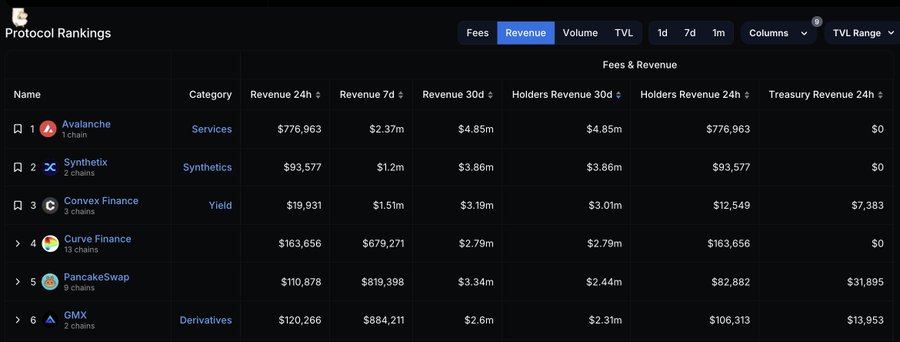

Analyzing the portfolio also opens up conversations about potential Yield Opportunities. There seems to be scope for DeFiLlama to venture into yield farming, providing them with opportunities for earning some passive income. This comes across as a particularly pertinent strategy, considering some specific yield farming opportunities relevant to this wallet.

In conclusion, DeFiLlama continues to cement its place as a reliable and much-loved brand in the cryptocurrency realm. It manages to sustain its operations mainly through grants and donations, underscoring the often-underappreciated value of maintaining simpler portfolios which, over time, tend to yield better returns. It’s also imperative to note that exploring opportunities for earning yields can be beneficial even for those who are highly adept in decentralized finance.

The presence of a diversified and healthy wallet underscores the wise and thoughtful approach to managing resources and highlights the potential avenues for further optimizing financial gains.

Special acknowledgment goes to several contributors including @0xMughal, @arndxt_xo, @0xTindorr, @rektdiomedes, @defitrader_, @Dynamo_Patrick, @VirtualKenji, @crypto_linn, @2lambro, @AkadoSang, @AngeloDodaro, @CryptoShiro_, @TheDeFISaint, @TheDeFinvestor, @0xnocta, @0xRemiss, and @Route2FI for their insights and contributions to the discussions surrounding DeFiLlama’s financial strategies and wallet holdings.

For those interested in exploring the specifics of this wallet address, a link will be provided in the subsequent communication.

Unlocking the Financial Strategies of DeFiLlama: A Deep Dive into Wallet Holdings and Opportunities

In today's discussion, we turn our focus to DeFiLlama, a brand that has garnered much affection and trust within the cryptocurrency sector. DeFiLlama's financial inflow stems primarily from donations, APIs, and grants.

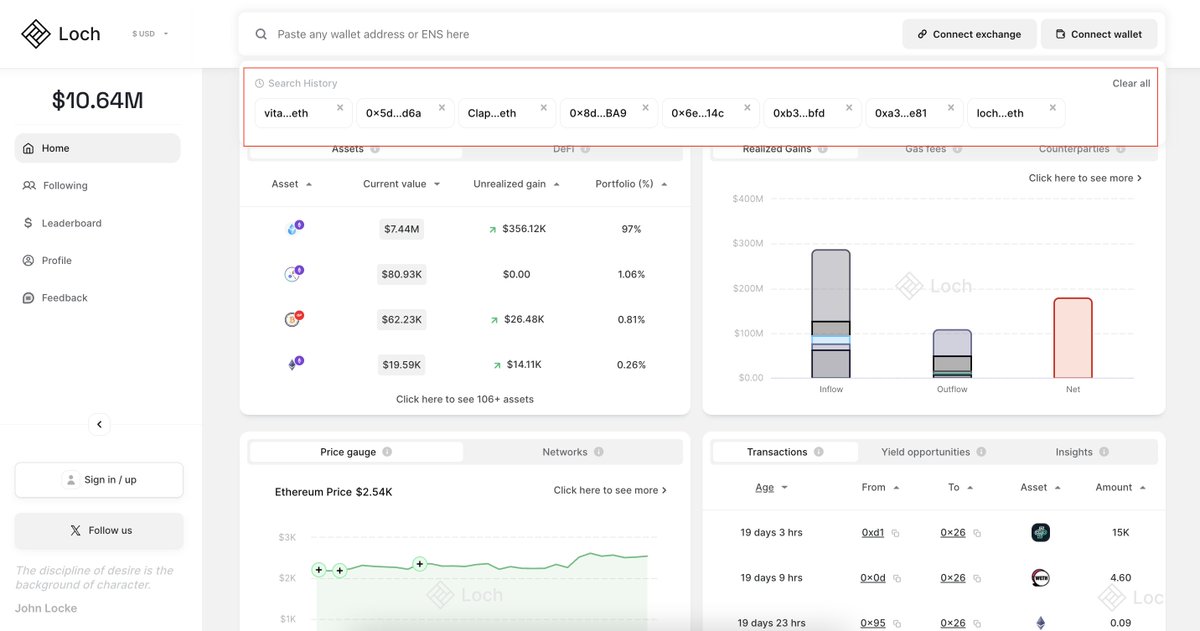

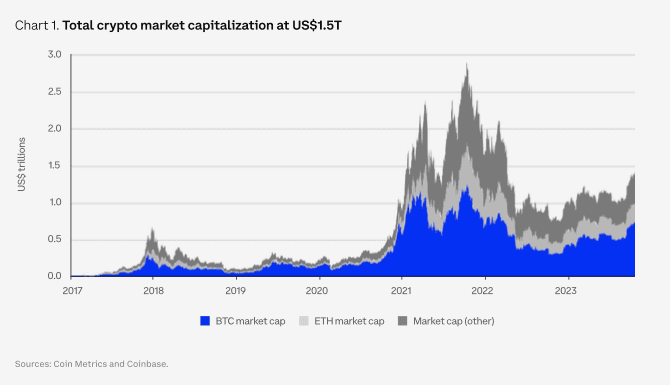

We have managed to unearth one of the public wallets of DeFiLlama to gain more insight into their financial strategies and holdings. The wallet we explored holds a well-diversified and robust portfolio amounting to a total of $252k, including significant holdings in ETH and various stablecoins, a fact that no doubt facilitates the payment processes to DeFiLlama contributors.

In examining the Current Spot Holdings, we observed:

- ETH: $114k

- DAI: $42k

- WETH: $29k

- USDT: $22k

- USDC: $13k

- Others: $32k

When evaluating the Cost Basis and Unrealized Gains of this wallet, it’s apparent that most holdings are either at breakeven or experiencing a loss, and there’s no active management or trading conducted with this particular wallet. Notably, the ETH holdings are approximately 16% down, showing an average price of $1898, compared to the current market price of $1593 as of September 28.

Shifting focus to Net Flows and Realized Gains, we unearthed some fascinating details. DeFiLlama’s wallet enjoys a 37% lifetime profit margin, with a significant proportion of these profits attributed to the $OP token. This profitable stance likely results from a grant DeFiLlama received the previous year from Optimism's RPGF program. Without this grant, their financial flows would have been in the negative.

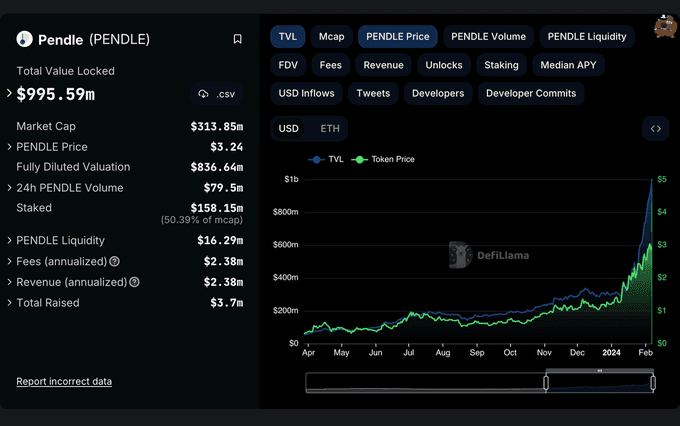

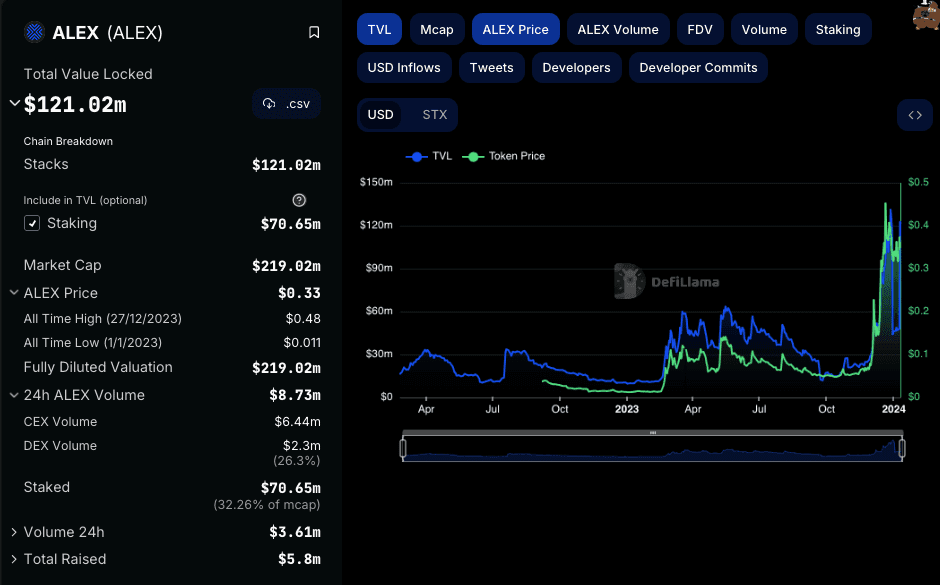

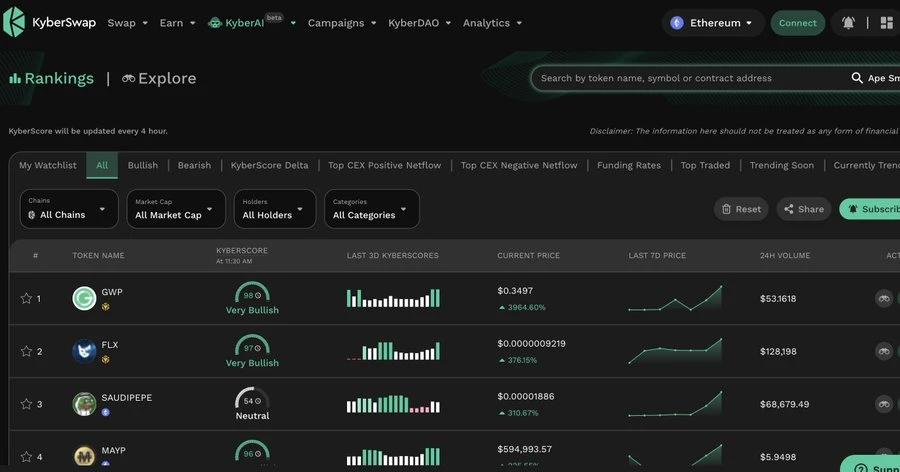

Analyzing the portfolio also opens up conversations about potential Yield Opportunities. There seems to be scope for DeFiLlama to venture into yield farming, providing them with opportunities for earning some passive income. This comes across as a particularly pertinent strategy, considering some specific yield farming opportunities relevant to this wallet.

In conclusion, DeFiLlama continues to cement its place as a reliable and much-loved brand in the cryptocurrency realm. It manages to sustain its operations mainly through grants and donations, underscoring the often-underappreciated value of maintaining simpler portfolios which, over time, tend to yield better returns. It’s also imperative to note that exploring opportunities for earning yields can be beneficial even for those who are highly adept in decentralized finance.

The presence of a diversified and healthy wallet underscores the wise and thoughtful approach to managing resources and highlights the potential avenues for further optimizing financial gains.

Special acknowledgment goes to several contributors including @0xMughal, @arndxt_xo, @0xTindorr, @rektdiomedes, @defitrader_, @Dynamo_Patrick, @VirtualKenji, @crypto_linn, @2lambro, @AkadoSang, @AngeloDodaro, @CryptoShiro_, @TheDeFISaint, @TheDeFinvestor, @0xnocta, @0xRemiss, and @Route2FI for their insights and contributions to the discussions surrounding DeFiLlama’s financial strategies and wallet holdings.

For those interested in exploring the specifics of this wallet address, a link will be provided in the subsequent communication.

Continue reading

Continue reading

Unlocking the Financial Strategies of DeFiLlama: A Deep Dive into Wallet Holdings and Opportunities

Sep 28, 2023

Unlocking the Financial Strategies of DeFiLlama: A Deep Dive into Wallet Holdings and Opportunities

Sep 28, 2023