Exciting Crypto Fund Raises

Crypto is not dead. In fact, some of the most exciting companies in the space are being built during bear markets. This past week saw three major fundraises that demonstrate the continued growth and innovation in the crypto industry.

ZKSync raised $200 million in a Series C round co-led by Blockchain Capital and Dragonfly Capital, with participation from Andreessen Horowitz. This funding brings the total raised by ZKSync to $258 million across seed, Series A, and Series B rounds.

ZKSync is a Ethereum scaling solution that uses a type of technology called a ZK-rollup. Rollups are a way to scale Ethereum by moving computation and state storage away from the Ethereum main chain and onto a separate layer. This can help reduce the load on Ethereum and improve transaction speeds. There are two types of rollups: Optimistic rollups and ZK-rollups. ZK-rollups are newer and more difficult to build, but they offer faster transaction finality and increased security.

Sepana raised $10 million in funding from Pitango, Balaji Srinivasan, Lattice Ventures, and Protocol Labs. This was Sepana's first round of funding. Sepana is a web3 search engine that aims to make it easier to discover content such as DAOs and NFTs on the decentralized web. The company's tooling powers millions of search queries on blockchains and dapps like Lens Protocol, VIA Mirror, and Deso Protocol. The funding will be used to hire senior blockchain engineers and search experts.

Ultimate Champions raised $4 million in funding from Binance Labs. This was the company's first round of funding. Ultimate Champions is a free-to-play, cross-league fantasy sports platform that uses officially licensed digital cards hosted as NFTs. Players can earn rewards by using their knowledge of sports and have full ownership over the assets they earn or purchase in the games. The platform, which is set to be released in April 2022, initially focused on football and has partnered with over 45 football clubs in Europe across nine leagues, including Arsenal, VfL Wolfsburg, and Stade de Reims. Games are in sync with real-world sporting event calendars, and the performances of each athlete will be translated into a virtual score.

Overall, these three fundraises demonstrate the continued growth and innovation in the crypto industry, with companies working on scaling solutions, search tooling for web3 content, and gaming using blockchain technology. It's an exciting time for the industry and there is no doubt that great companies will continue to be built in bear markets.

Ethereum's Shanghai Upgrade

The Shanghai upgrade is the next major milestone for Ethereum and is set to have a significant impact on ETH's supply and price. In this article, we'll explore the Shanghai upgrade and its implications for ETH, its supply and price, as well as its impact on Liquid Staking Derivatives (LSDs).

What is the Shanghai Upgrade? The Shanghai upgrade is a forthcoming Ethereum network upgrade that will allow validators to unstake their ETH, releasing a massive amount of ETH into the free-floating market. The upgrade is scheduled to occur in March 2023.

How Will it Affect ETH's Supply and Price? The first order of thinking dictates that the Shanghai upgrade will lead to a massive increase in the supply of free-floating ETH as long-time validators finally unstake their ETH. However, second order thinking suggests that the ability to stake and unstake ETH freely is actually bullish for the price of ETH. All the investors who have waited on the sidelines will finally have the confidence to stake ETH, as withdrawal is now guaranteed.

The Shanghai upgrade is projected to double the amount of ETH being staked, from approximately 16 million ETH to 32 million ETH. This increase in staked ETH will reduce the free float and create organic scarcity, which is bullish for the price of ETH.

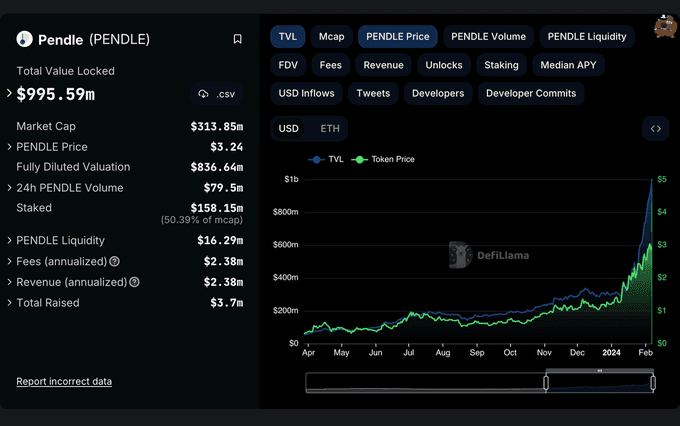

What Does it Mean for Liquid Staking Derivatives (LSDs)? The Shanghai upgrade is set to have a significant impact on LSDs, which have already seen a massive run-up in anticipation of the upgrade. As more ETH is staked through LSDs after the upgrade, the fees earned by LSDs' native tokens will increase. However, as more ETH is staked, the staking yield for ETH decreases, which means that the LSD that can offer the highest yield sustainably is likely to win in the long term. The author believes that Frax Finance (FXS) is most likely to be the LSD that wins in the long term.

In conclusion, the Shanghai upgrade is a major milestone for Ethereum that is set to have a significant impact on ETH's supply, price, and LSDs. As the upgrade approaches, investors should keep an eye on the market to see how the changes play out.

Exciting Crypto Fund Raises

Crypto is not dead. In fact, some of the most exciting companies in the space are being built during bear markets. This past week saw three major fundraises that demonstrate the continued growth and innovation in the crypto industry.

ZKSync raised $200 million in a Series C round co-led by Blockchain Capital and Dragonfly Capital, with participation from Andreessen Horowitz. This funding brings the total raised by ZKSync to $258 million across seed, Series A, and Series B rounds.

ZKSync is a Ethereum scaling solution that uses a type of technology called a ZK-rollup. Rollups are a way to scale Ethereum by moving computation and state storage away from the Ethereum main chain and onto a separate layer. This can help reduce the load on Ethereum and improve transaction speeds. There are two types of rollups: Optimistic rollups and ZK-rollups. ZK-rollups are newer and more difficult to build, but they offer faster transaction finality and increased security.

Sepana raised $10 million in funding from Pitango, Balaji Srinivasan, Lattice Ventures, and Protocol Labs. This was Sepana's first round of funding. Sepana is a web3 search engine that aims to make it easier to discover content such as DAOs and NFTs on the decentralized web. The company's tooling powers millions of search queries on blockchains and dapps like Lens Protocol, VIA Mirror, and Deso Protocol. The funding will be used to hire senior blockchain engineers and search experts.

Ultimate Champions raised $4 million in funding from Binance Labs. This was the company's first round of funding. Ultimate Champions is a free-to-play, cross-league fantasy sports platform that uses officially licensed digital cards hosted as NFTs. Players can earn rewards by using their knowledge of sports and have full ownership over the assets they earn or purchase in the games. The platform, which is set to be released in April 2022, initially focused on football and has partnered with over 45 football clubs in Europe across nine leagues, including Arsenal, VfL Wolfsburg, and Stade de Reims. Games are in sync with real-world sporting event calendars, and the performances of each athlete will be translated into a virtual score.

Overall, these three fundraises demonstrate the continued growth and innovation in the crypto industry, with companies working on scaling solutions, search tooling for web3 content, and gaming using blockchain technology. It's an exciting time for the industry and there is no doubt that great companies will continue to be built in bear markets.

Ethereum's Shanghai Upgrade

The Shanghai upgrade is the next major milestone for Ethereum and is set to have a significant impact on ETH's supply and price. In this article, we'll explore the Shanghai upgrade and its implications for ETH, its supply and price, as well as its impact on Liquid Staking Derivatives (LSDs).

What is the Shanghai Upgrade? The Shanghai upgrade is a forthcoming Ethereum network upgrade that will allow validators to unstake their ETH, releasing a massive amount of ETH into the free-floating market. The upgrade is scheduled to occur in March 2023.

How Will it Affect ETH's Supply and Price? The first order of thinking dictates that the Shanghai upgrade will lead to a massive increase in the supply of free-floating ETH as long-time validators finally unstake their ETH. However, second order thinking suggests that the ability to stake and unstake ETH freely is actually bullish for the price of ETH. All the investors who have waited on the sidelines will finally have the confidence to stake ETH, as withdrawal is now guaranteed.

The Shanghai upgrade is projected to double the amount of ETH being staked, from approximately 16 million ETH to 32 million ETH. This increase in staked ETH will reduce the free float and create organic scarcity, which is bullish for the price of ETH.

What Does it Mean for Liquid Staking Derivatives (LSDs)? The Shanghai upgrade is set to have a significant impact on LSDs, which have already seen a massive run-up in anticipation of the upgrade. As more ETH is staked through LSDs after the upgrade, the fees earned by LSDs' native tokens will increase. However, as more ETH is staked, the staking yield for ETH decreases, which means that the LSD that can offer the highest yield sustainably is likely to win in the long term. The author believes that Frax Finance (FXS) is most likely to be the LSD that wins in the long term.

In conclusion, the Shanghai upgrade is a major milestone for Ethereum that is set to have a significant impact on ETH's supply, price, and LSDs. As the upgrade approaches, investors should keep an eye on the market to see how the changes play out.

Continue reading

Continue reading

Exciting Crypto Fund Raises AND ETH Shanghai Upgrade

Dec 19, 2022

Exciting Crypto Fund Raises AND ETH Shanghai Upgrade

Dec 19, 2022