A Contrarian Perspective: Rational Valuation of Layer 2s in the Cryptocurrency Landscape

Introduction:

In a sphere often characterized by its high volatility and speculative investments, the cryptocurrency market is regarded by many as a colossal Keynesian beauty contest. Investments are largely influenced by market trends, overshadowing fundamental value. A contrarian perspective, however, suggests that Layer 2 solutions like $ARB, $MATIC, and $OP are rationally valued. This article evaluates this perspective by examining the relative basis of valuations in the crypto landscape, focusing on the contrast between market trends and fundamental values.

The Crypto Beauty Contest:

The crypto market, driven by relative trends rather than absolute fundamentals, often witnesses investment decisions based on ‘what’s hot’ in the market. In such a scenario, Layer 2 solutions, despite their seemingly high absolute valuations, make sense from a relative valuation standpoint.

Understanding Layer 2s’ Relative Valuations:

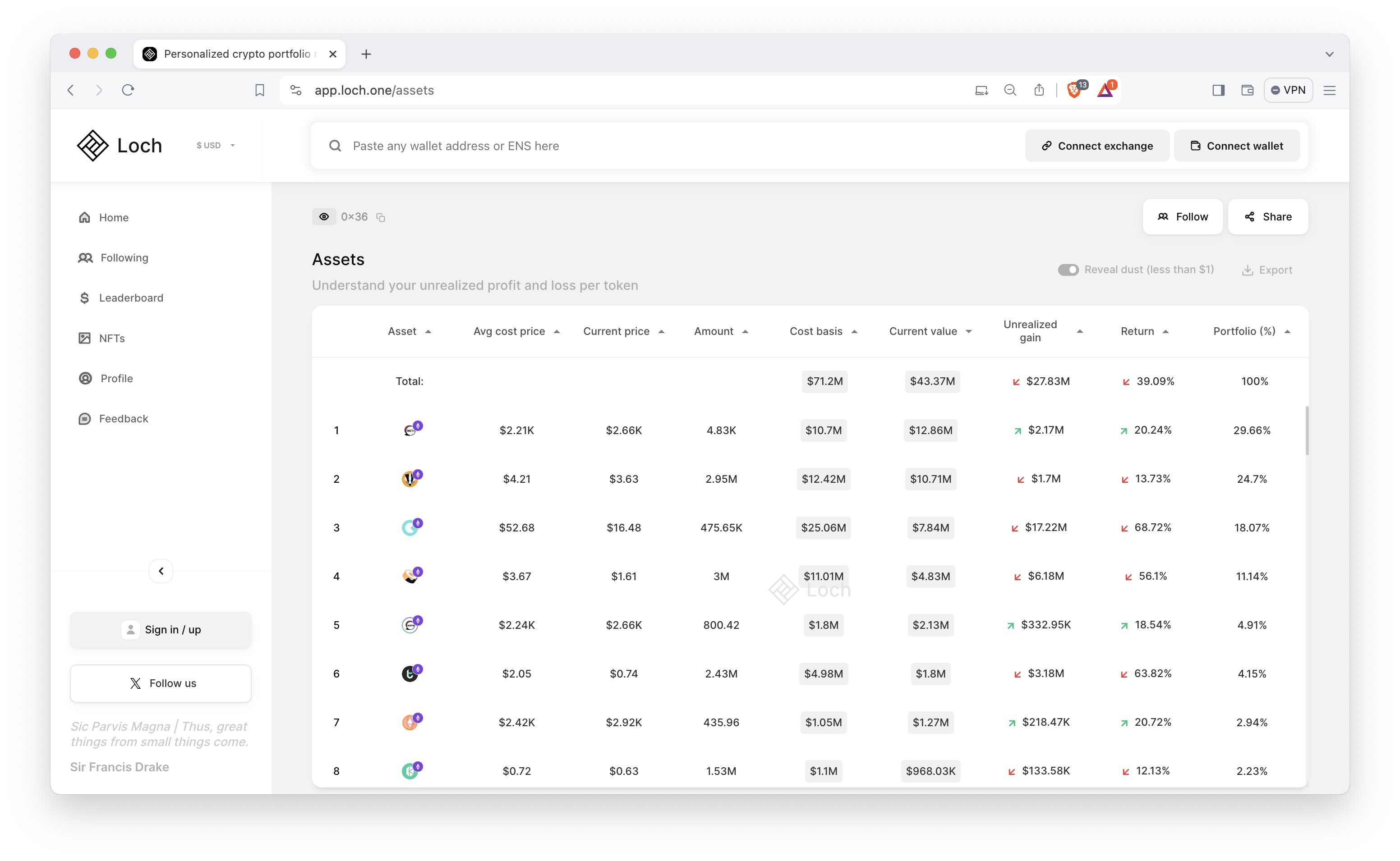

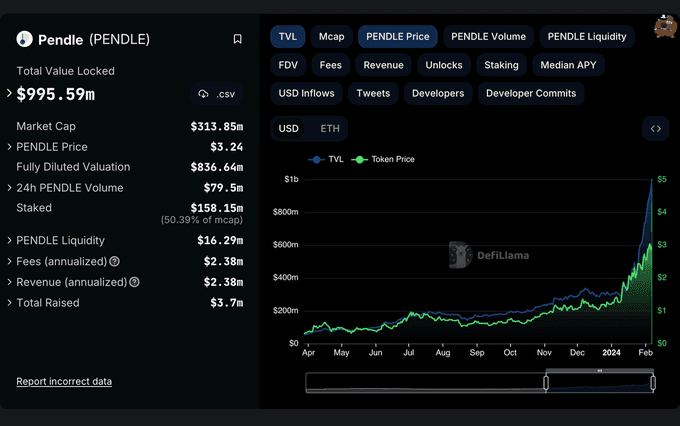

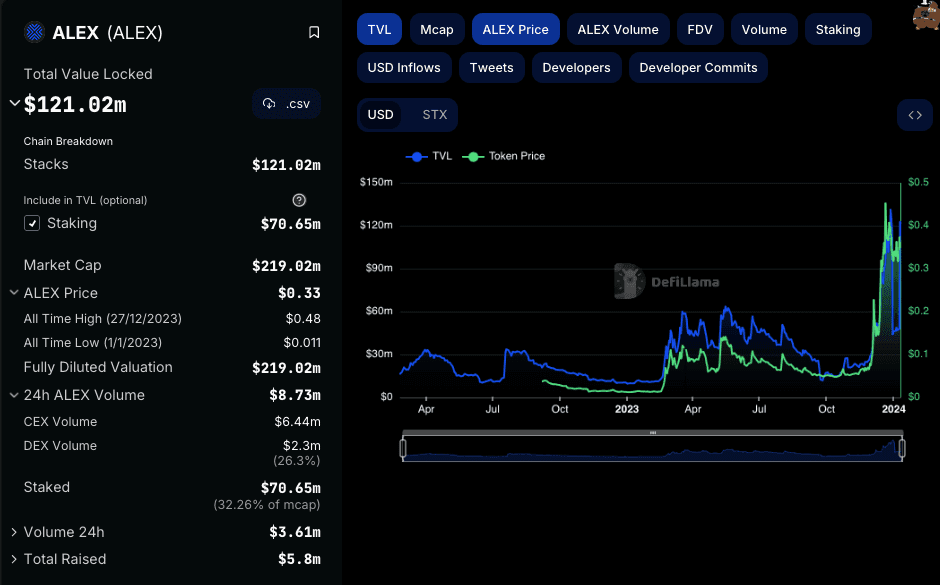

To comprehend the relative rationality of Layer 2 valuations, it’s essential to evaluate them against prominent statistics in crypto, namely Total Value Locked (TVL), Dex volume, and Daily Active Users (DAUs).

FDV (Fully Diluted Valuation): $ARB ($13b) leads the way, followed by $MATIC ($10b) and $OP ($9b).

TVL: Arbitrum ($2.4b) is predominant, with Polygon ($1b) and Optimism ($910m) trailing behind.

Dex Volume: Arbitrum dominates with $400m, followed by Polygon ($200m) and Optimism ($50m).

DAUs: Polygon stands out with 400k, Arbitrum follows with 300k, and Optimism has 200k.

Rationality in Valuation:

Arbitrum, exhibiting the highest usage statistics, logically holds the highest FDV, implying a correlation between usage and valuation, thus validating the rationality in Layer 2s’ valuations. The ordering of these Layer 2 solutions in terms of their valuations corresponds more or less accurately with their ranking in terms of usage stats, which are the metrics that people predominantly care about in crypto.

Conclusion:

In a market swayed by trends and relative valuations, the contrarian perspective posits that Layer 2s are being valued rationally. The usage statistics and the following valuations of Layer 2s like $ARB, $MATIC, and $OP reflect a coherent correlation, reinforcing the rationality argument.

While the crypto landscape remains a fascinating domain driven by market sentiments and emerging trends, a deeper comprehension of relative valuations provides insights that go beyond the market frenzy. For a detailed and nuanced understanding of these dynamics, insights from experts like Prithvir provide an enriched perspective on the crypto domain.

Acknowledgments:

The data utilized for this analysis is attributed to @artemis__xyz, and for continuous insights and discussions related to blockchain technology and the crypto world, connect with Prithvir.

A Contrarian Perspective: Rational Valuation of Layer 2s in the Cryptocurrency Landscape

Introduction:

In a sphere often characterized by its high volatility and speculative investments, the cryptocurrency market is regarded by many as a colossal Keynesian beauty contest. Investments are largely influenced by market trends, overshadowing fundamental value. A contrarian perspective, however, suggests that Layer 2 solutions like $ARB, $MATIC, and $OP are rationally valued. This article evaluates this perspective by examining the relative basis of valuations in the crypto landscape, focusing on the contrast between market trends and fundamental values.

The Crypto Beauty Contest:

The crypto market, driven by relative trends rather than absolute fundamentals, often witnesses investment decisions based on ‘what’s hot’ in the market. In such a scenario, Layer 2 solutions, despite their seemingly high absolute valuations, make sense from a relative valuation standpoint.

Understanding Layer 2s’ Relative Valuations:

To comprehend the relative rationality of Layer 2 valuations, it’s essential to evaluate them against prominent statistics in crypto, namely Total Value Locked (TVL), Dex volume, and Daily Active Users (DAUs).

FDV (Fully Diluted Valuation): $ARB ($13b) leads the way, followed by $MATIC ($10b) and $OP ($9b).

TVL: Arbitrum ($2.4b) is predominant, with Polygon ($1b) and Optimism ($910m) trailing behind.

Dex Volume: Arbitrum dominates with $400m, followed by Polygon ($200m) and Optimism ($50m).

DAUs: Polygon stands out with 400k, Arbitrum follows with 300k, and Optimism has 200k.

Rationality in Valuation:

Arbitrum, exhibiting the highest usage statistics, logically holds the highest FDV, implying a correlation between usage and valuation, thus validating the rationality in Layer 2s’ valuations. The ordering of these Layer 2 solutions in terms of their valuations corresponds more or less accurately with their ranking in terms of usage stats, which are the metrics that people predominantly care about in crypto.

Conclusion:

In a market swayed by trends and relative valuations, the contrarian perspective posits that Layer 2s are being valued rationally. The usage statistics and the following valuations of Layer 2s like $ARB, $MATIC, and $OP reflect a coherent correlation, reinforcing the rationality argument.

While the crypto landscape remains a fascinating domain driven by market sentiments and emerging trends, a deeper comprehension of relative valuations provides insights that go beyond the market frenzy. For a detailed and nuanced understanding of these dynamics, insights from experts like Prithvir provide an enriched perspective on the crypto domain.

Acknowledgments:

The data utilized for this analysis is attributed to @artemis__xyz, and for continuous insights and discussions related to blockchain technology and the crypto world, connect with Prithvir.

Continue reading

Continue reading

A Contrarian Perspective: Rational Valuation of Layer 2s in the Cryptocurrency Landscape

May 12, 2023

A Contrarian Perspective: Rational Valuation of Layer 2s in the Cryptocurrency Landscape

May 12, 2023