Spotlight on Andrew Kang: The God-Tier Narrative Trader

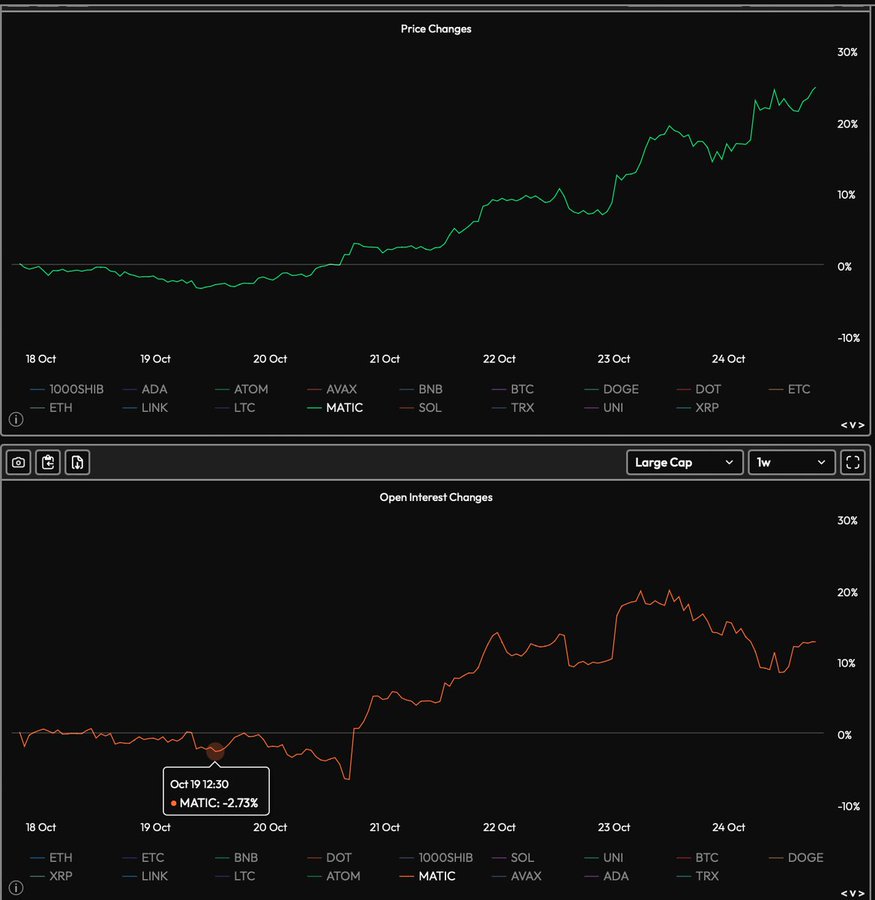

In the dynamic world of cryptocurrency trading, where narratives often drive investment strategies, few have demonstrated as much prowess as Andrew Kang (@Rewkang). Prithvir, a notable crypto analyst, casts a spotlight on Kang's remarkable track record over the past half-year and offers insights into his bullish bets.

A Stellar Performance by Kang

Andrew Kang stands out with an enviable 70% return over the past six months, translating to approximately $80 million in positive net flows. Such impressive feats validate his status as a top-tier narrative trader in the crypto space.

Kang's Bullish Bet: $RDNT

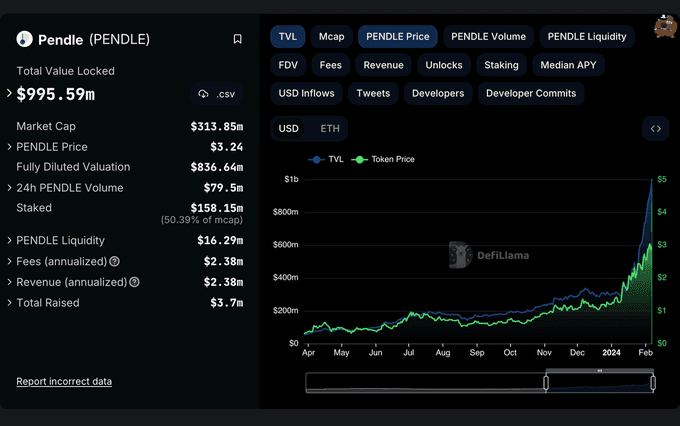

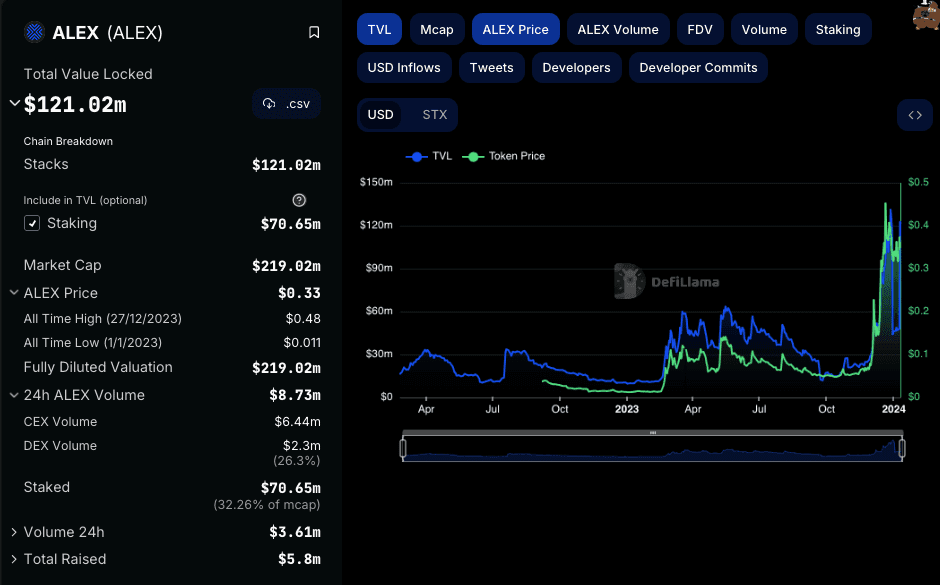

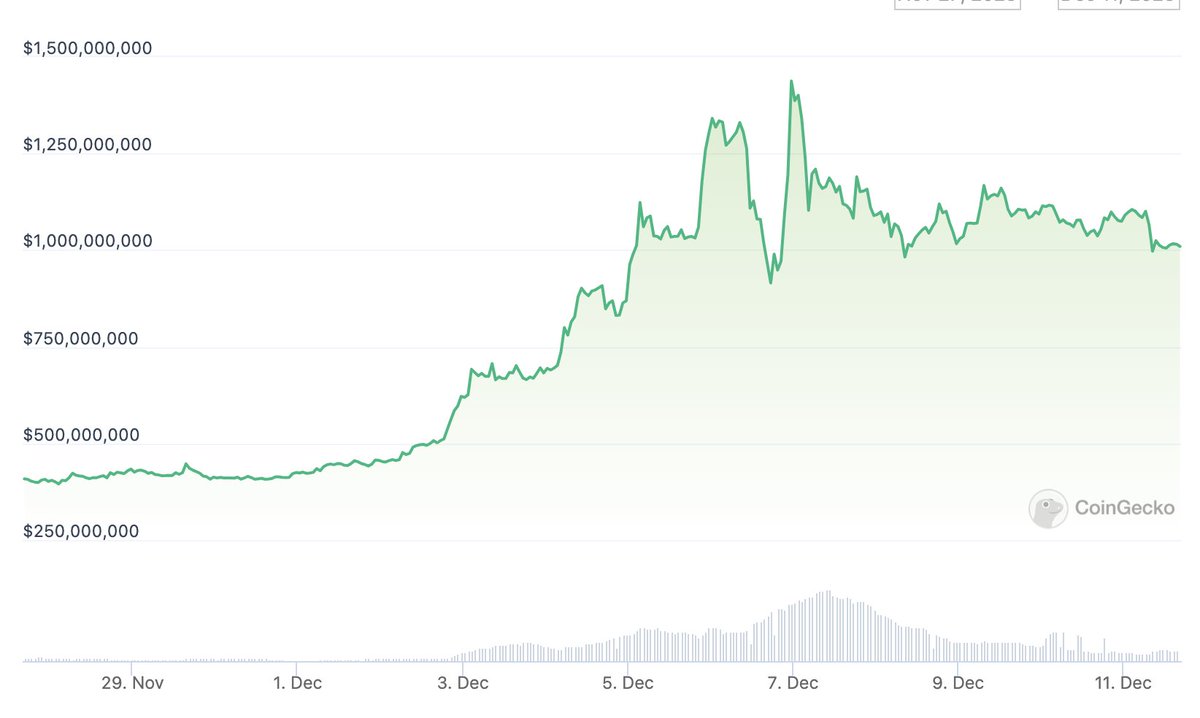

Andrew's current bullish sentiment centers around the $RDNT token, representing the Radiant protocol.

What is Radiant? Radiant stands out as an omni-chain lending protocol. Through its utilization of LayerZero, the protocol facilitates cross-chain lending and borrowing, a feature setting it apart in the DeFi space.

Why is Kang Bullish on Radiant? Several reasons back Kang's optimistic stance on $RDNT:

Established DeFi protocols like Compound and AAVE seem to lag in innovation compared to newer entrants like Radiant.

The compelling tokenomics of $RDNT.

Radiant's capability to support cross-chain borrowing and lending.

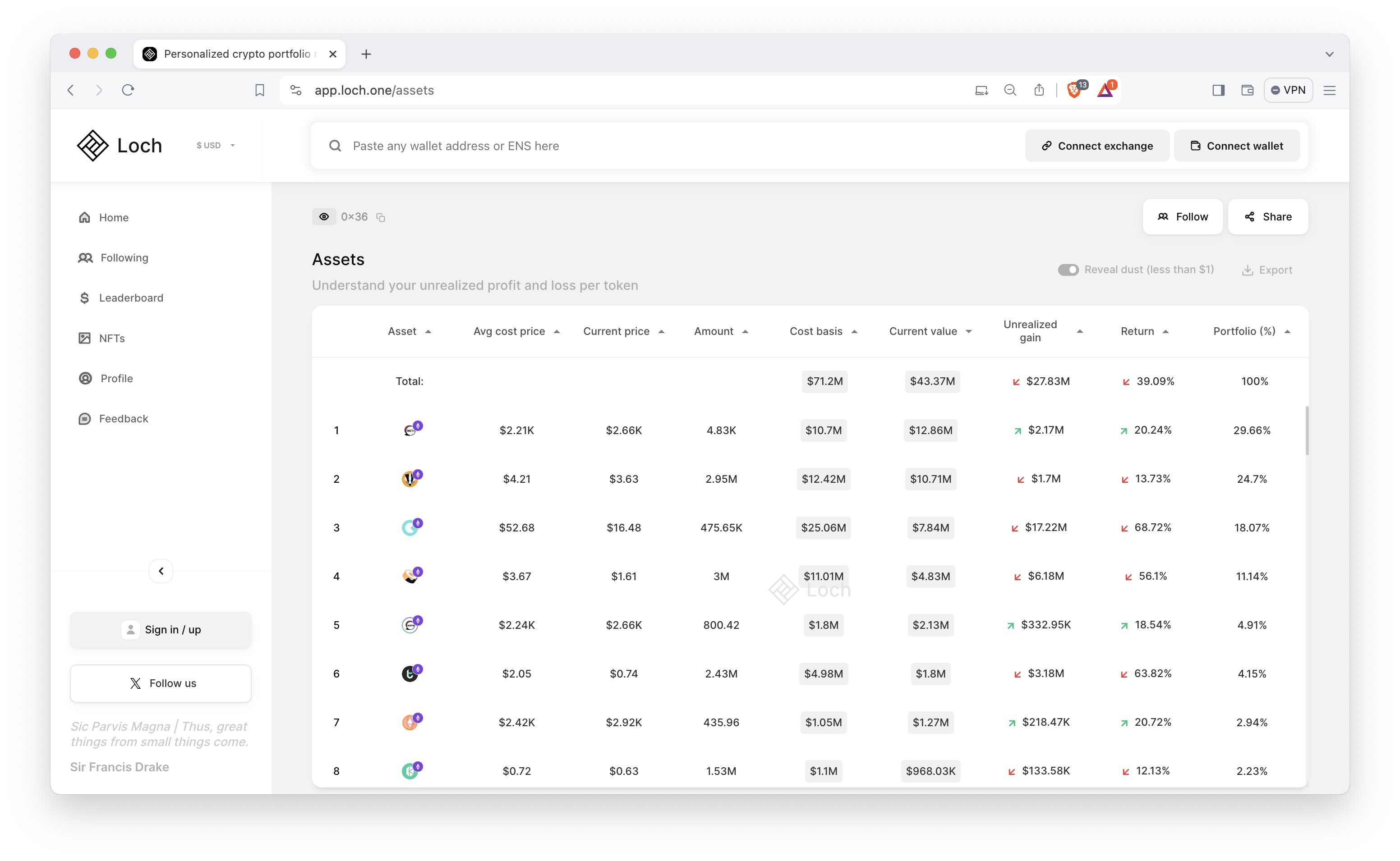

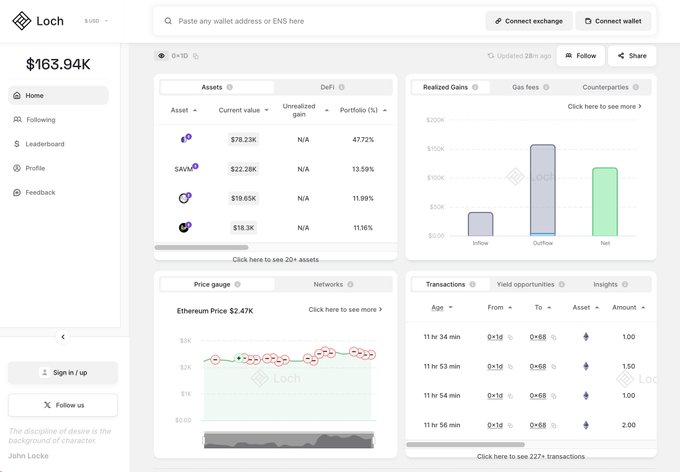

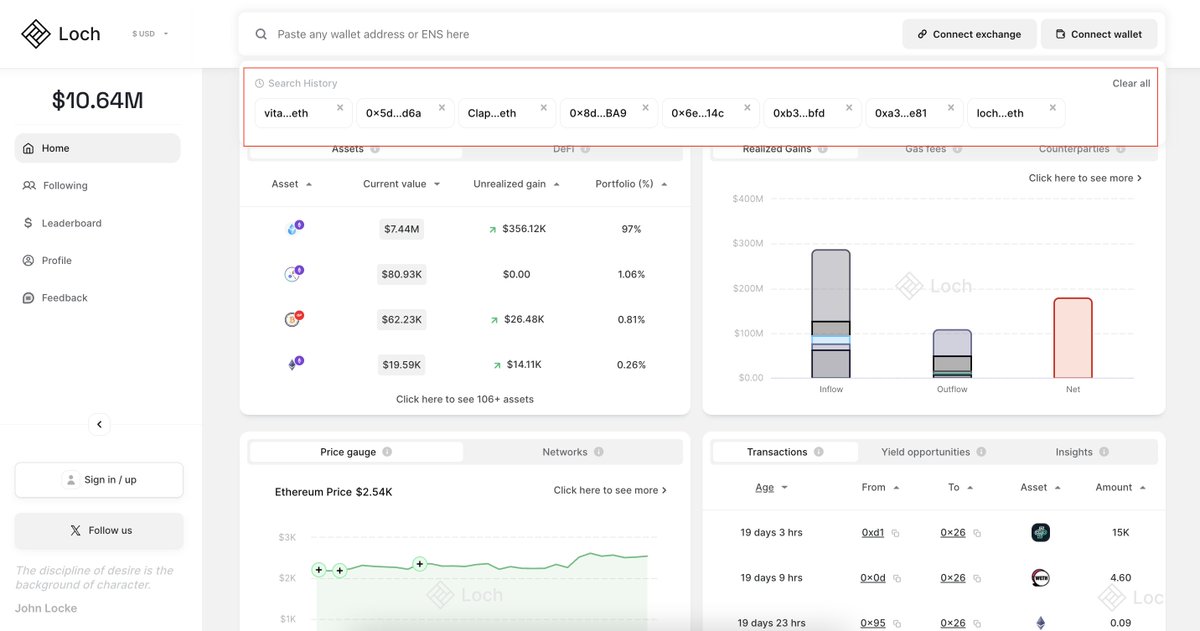

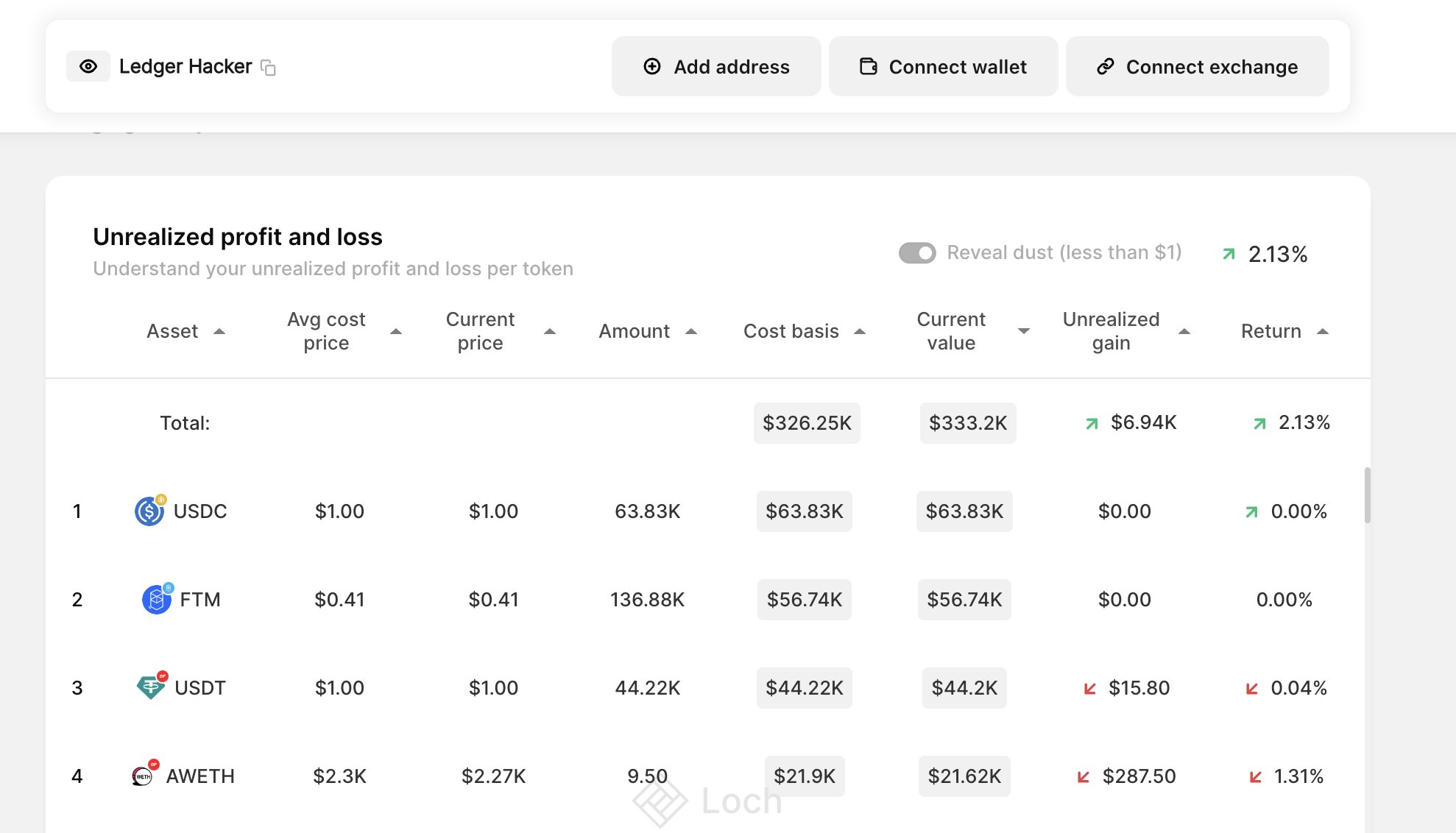

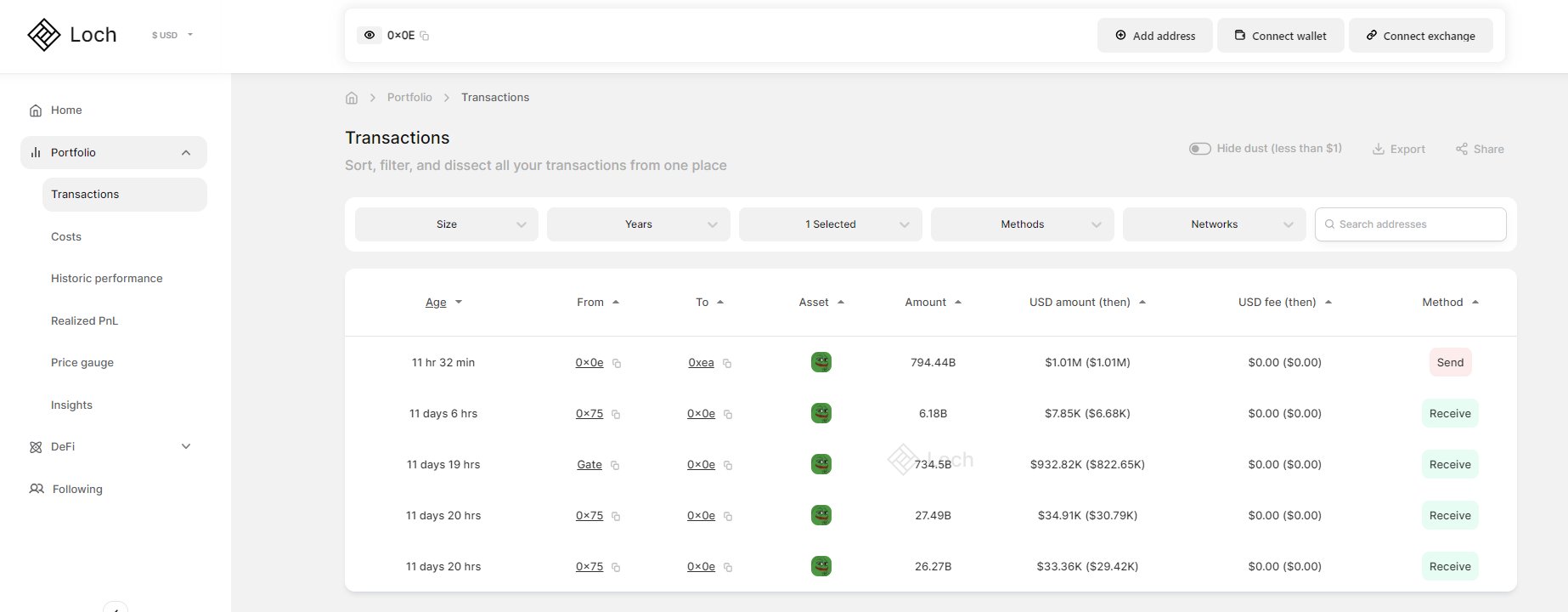

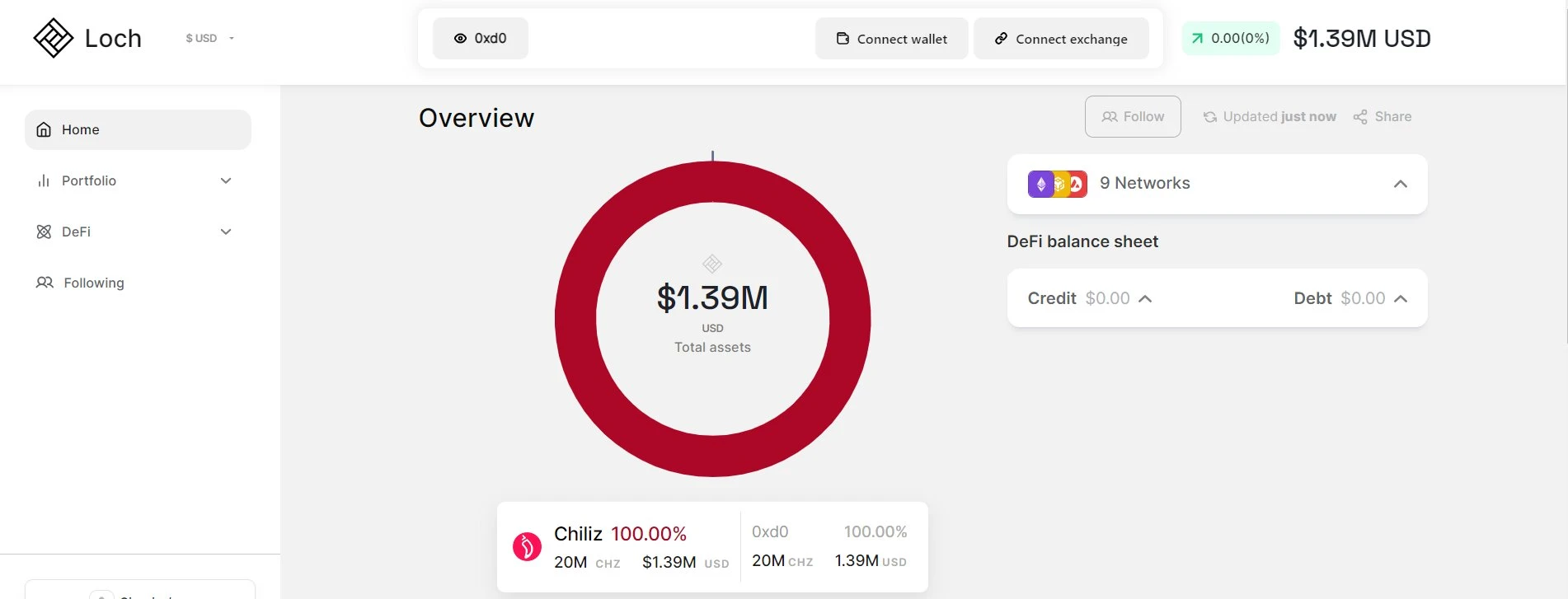

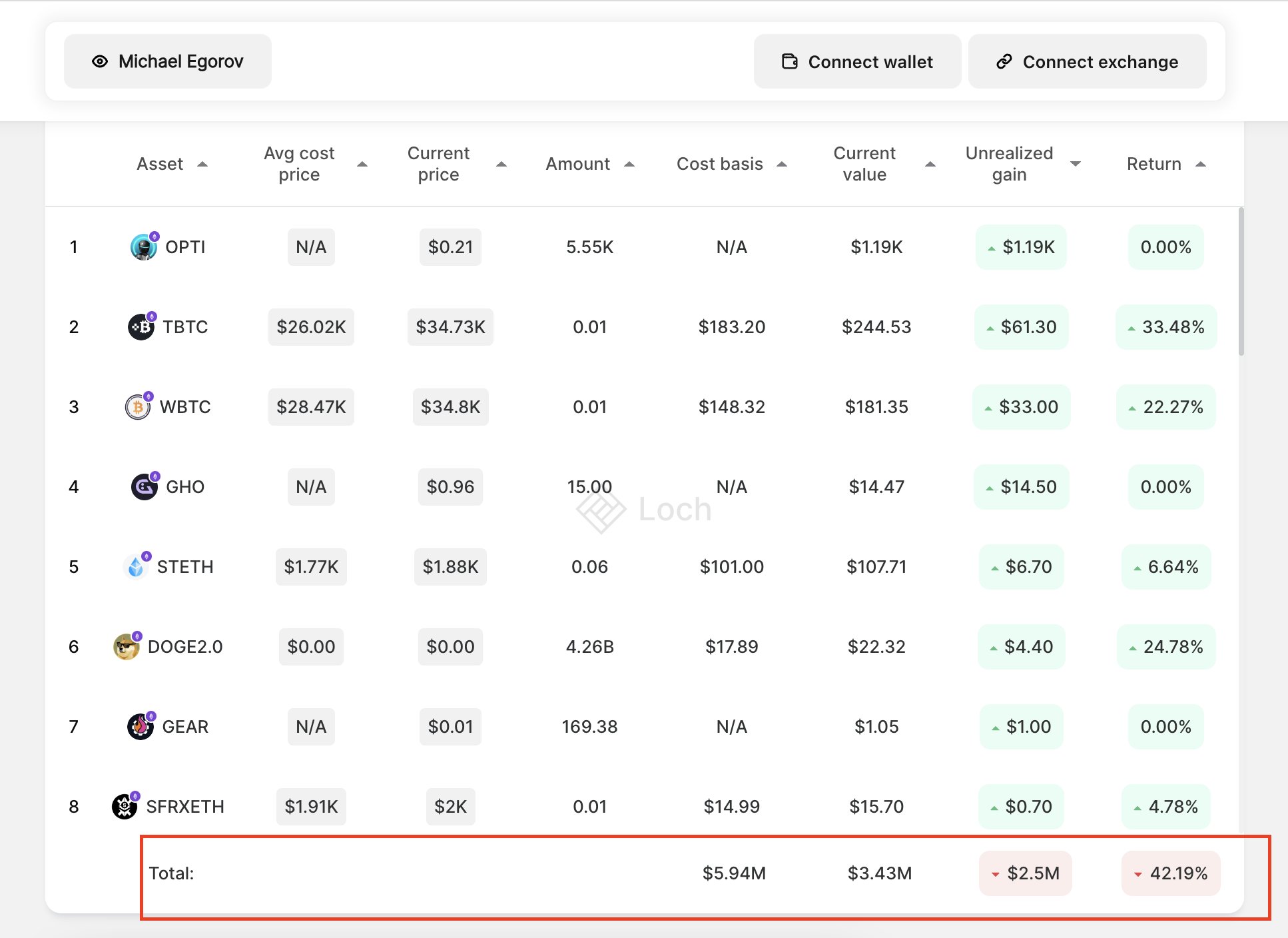

A Glimpse Into Kang's Portfolio

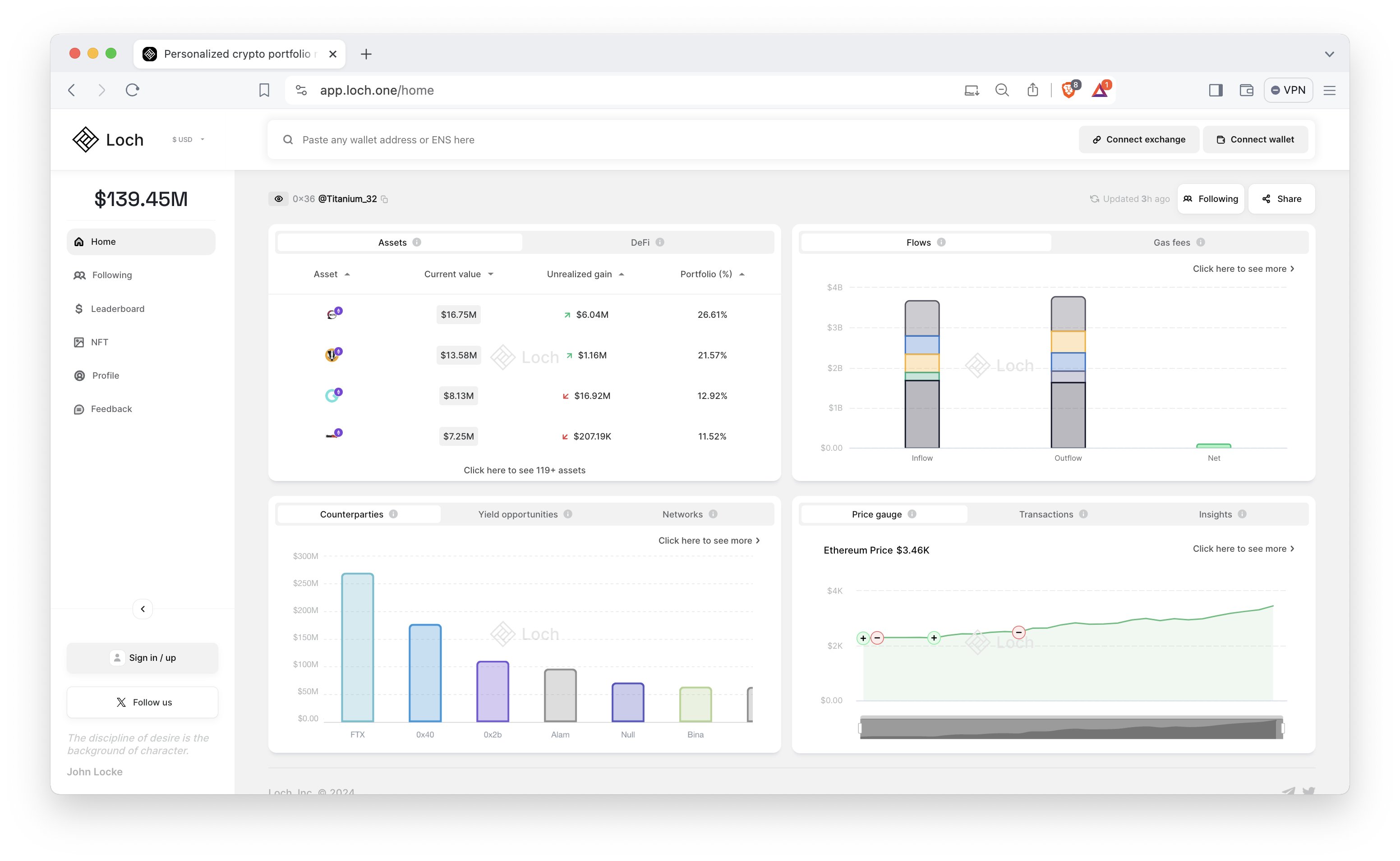

Prithvir offers a snapshot into Kang's holdings, revealing notable investments:

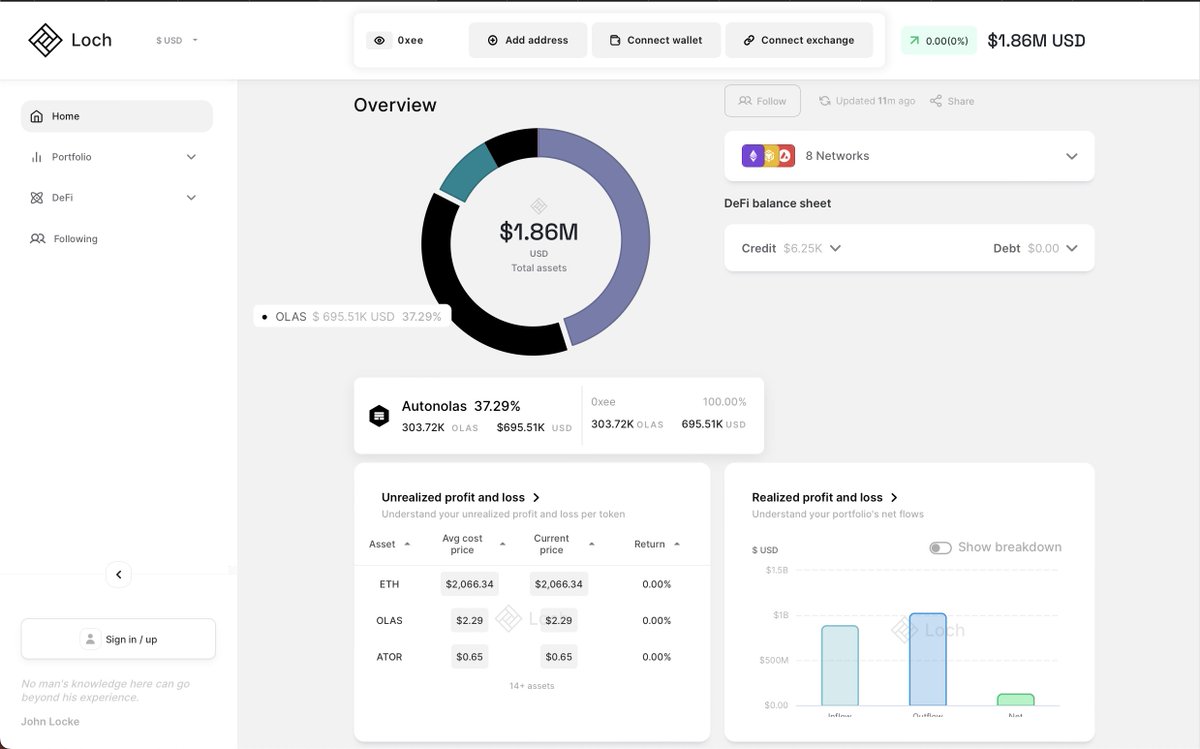

$RDNT: Kang holds a significant position in $RDNT, valued at almost $1.2 million. Notably, he leveraged Radiant v2 to deposit $ARB, borrowing $USDC against it. His average cost basis stands at about $0.3.

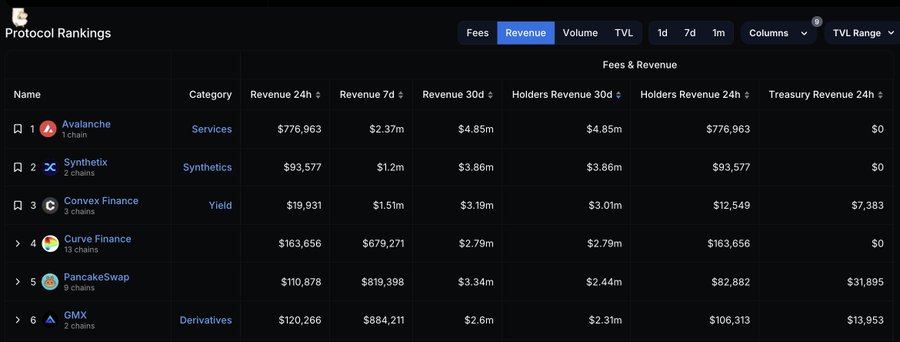

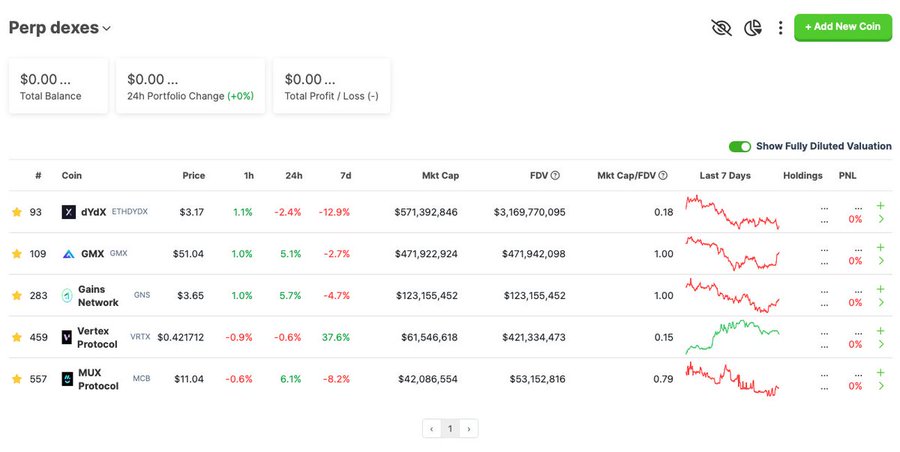

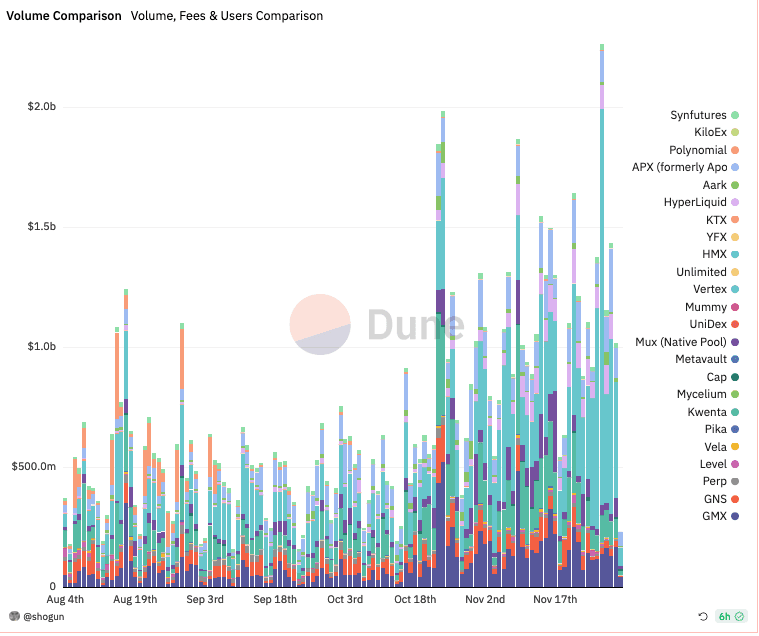

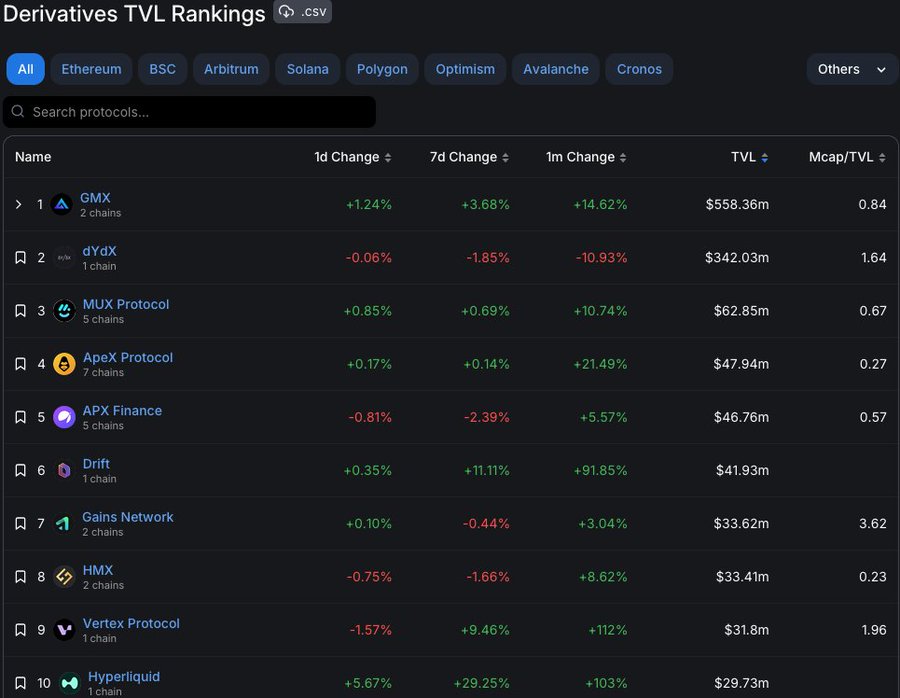

Other Holdings: Besides $RDNT, Kang's portfolio features $BICO, $ETH, $KWENTA, and $MUX. He possesses spot holdings in $BICO and $ETH, while his $KWENTA and $MUX assets are staked. It's worth noting that Kwenta, built atop Synthetix and operating on Optimism, is a perpetual decentralized exchange. In contrast, Mux functions as a perpetual dex aggregator on Arbitrum.

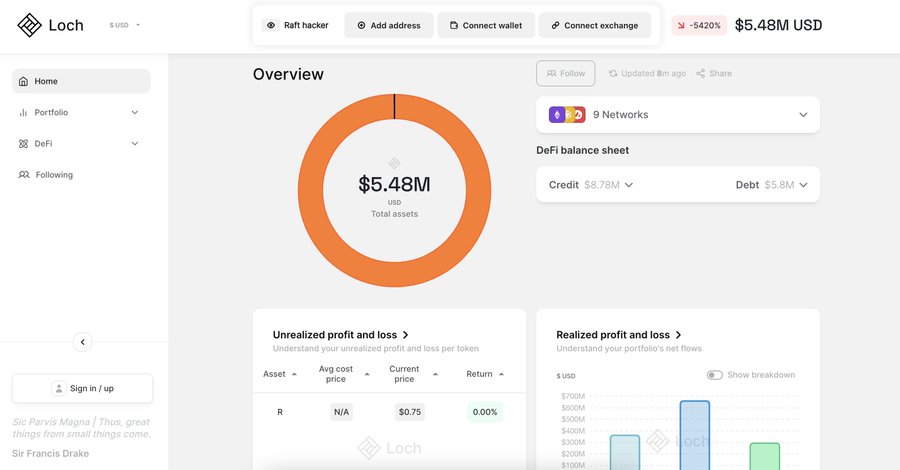

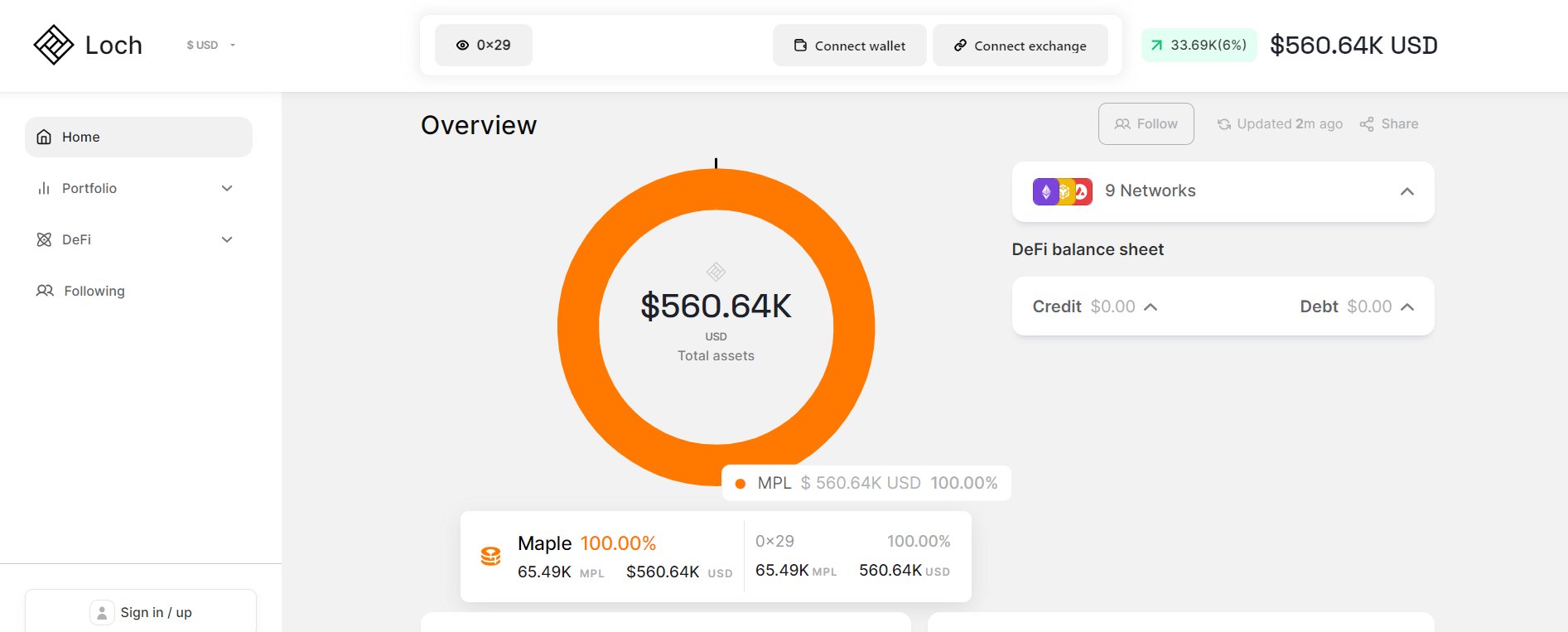

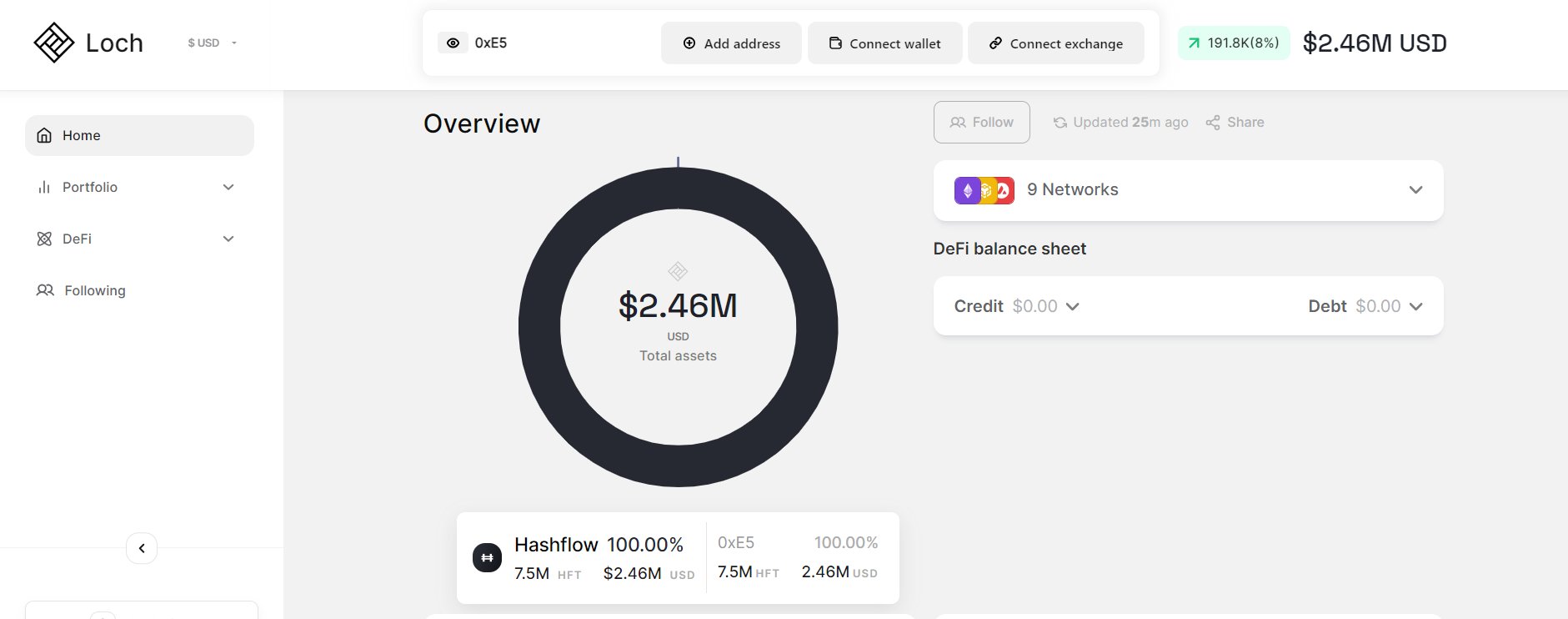

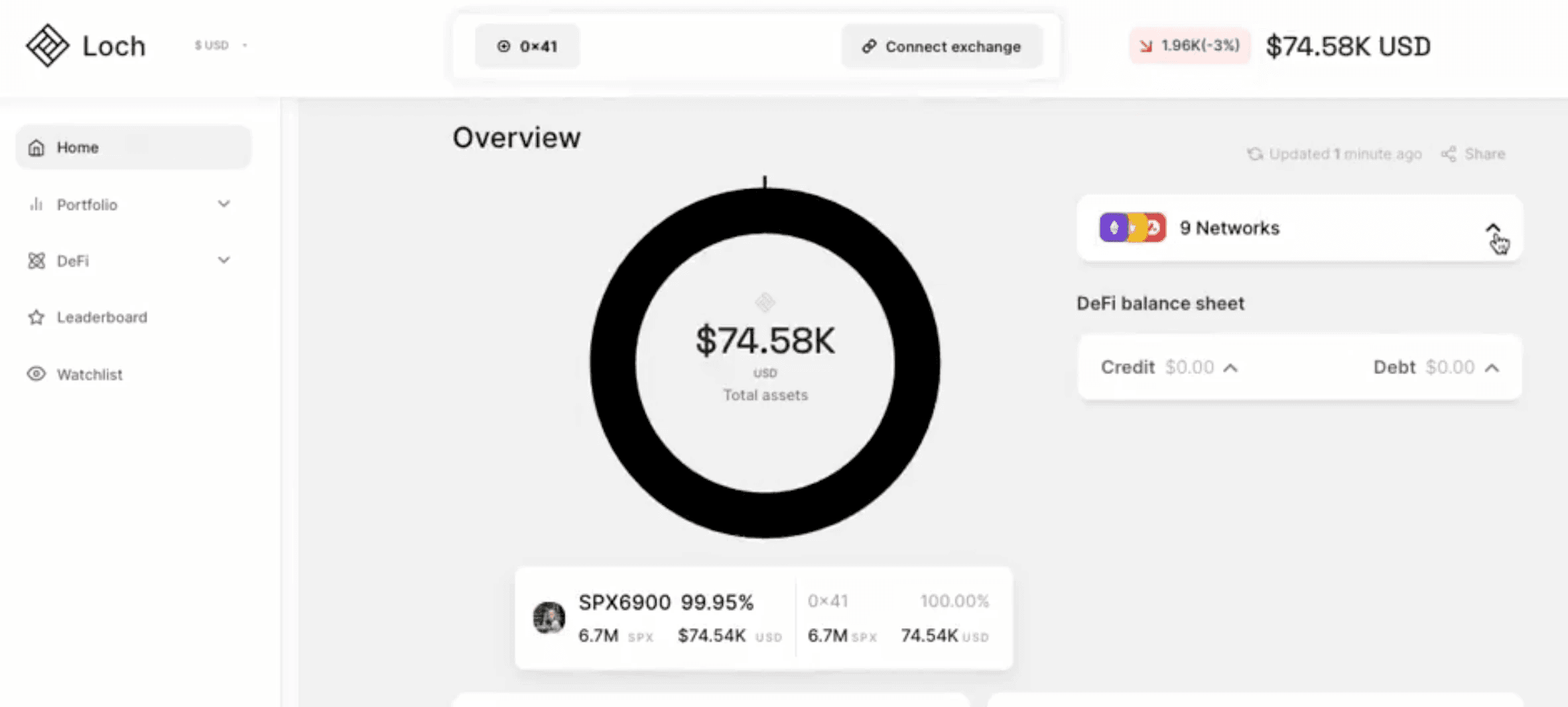

A Snapshot of Kang's Performance

Over the past six months, Kang's wallet showcased here has flourished. With an uptick of 70% and net flows approximating $80 million, Kang's trading acumen is evident. However, Prithvir cautions that this wallet represents only a fragment of Kang's overall portfolio and might not reflect his complete trading performance.

In Conclusion: The Art of Narrative Trading

Andrew Kang's journey underscores the potential of narrative-driven trading strategies in the crypto domain. While his bets on protocols like Radiant validate the continuous evolution of the DeFi sector, they also highlight the importance of staying ahead of the curve and adapting to emerging narratives.

Spotlight on Andrew Kang: The God-Tier Narrative Trader

In the dynamic world of cryptocurrency trading, where narratives often drive investment strategies, few have demonstrated as much prowess as Andrew Kang (@Rewkang). Prithvir, a notable crypto analyst, casts a spotlight on Kang's remarkable track record over the past half-year and offers insights into his bullish bets.

A Stellar Performance by Kang

Andrew Kang stands out with an enviable 70% return over the past six months, translating to approximately $80 million in positive net flows. Such impressive feats validate his status as a top-tier narrative trader in the crypto space.

Kang's Bullish Bet: $RDNT

Andrew's current bullish sentiment centers around the $RDNT token, representing the Radiant protocol.

What is Radiant? Radiant stands out as an omni-chain lending protocol. Through its utilization of LayerZero, the protocol facilitates cross-chain lending and borrowing, a feature setting it apart in the DeFi space.

Why is Kang Bullish on Radiant? Several reasons back Kang's optimistic stance on $RDNT:

Established DeFi protocols like Compound and AAVE seem to lag in innovation compared to newer entrants like Radiant.

The compelling tokenomics of $RDNT.

Radiant's capability to support cross-chain borrowing and lending.

A Glimpse Into Kang's Portfolio

Prithvir offers a snapshot into Kang's holdings, revealing notable investments:

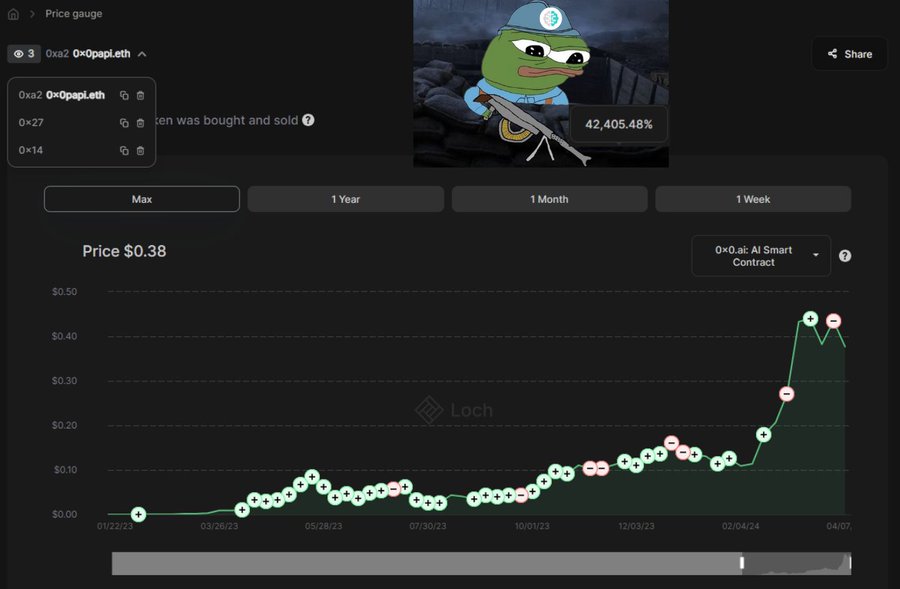

$RDNT: Kang holds a significant position in $RDNT, valued at almost $1.2 million. Notably, he leveraged Radiant v2 to deposit $ARB, borrowing $USDC against it. His average cost basis stands at about $0.3.

Other Holdings: Besides $RDNT, Kang's portfolio features $BICO, $ETH, $KWENTA, and $MUX. He possesses spot holdings in $BICO and $ETH, while his $KWENTA and $MUX assets are staked. It's worth noting that Kwenta, built atop Synthetix and operating on Optimism, is a perpetual decentralized exchange. In contrast, Mux functions as a perpetual dex aggregator on Arbitrum.

A Snapshot of Kang's Performance

Over the past six months, Kang's wallet showcased here has flourished. With an uptick of 70% and net flows approximating $80 million, Kang's trading acumen is evident. However, Prithvir cautions that this wallet represents only a fragment of Kang's overall portfolio and might not reflect his complete trading performance.

In Conclusion: The Art of Narrative Trading

Andrew Kang's journey underscores the potential of narrative-driven trading strategies in the crypto domain. While his bets on protocols like Radiant validate the continuous evolution of the DeFi sector, they also highlight the importance of staying ahead of the curve and adapting to emerging narratives.

Continue reading

Continue reading

Spotlight on Andrew Kang: The God-Tier Narrative Trader

Jun 4, 2023

Spotlight on Andrew Kang: The God-Tier Narrative Trader

Jun 4, 2023