Deciphering L2 Dominance: Metrics and Market Movements

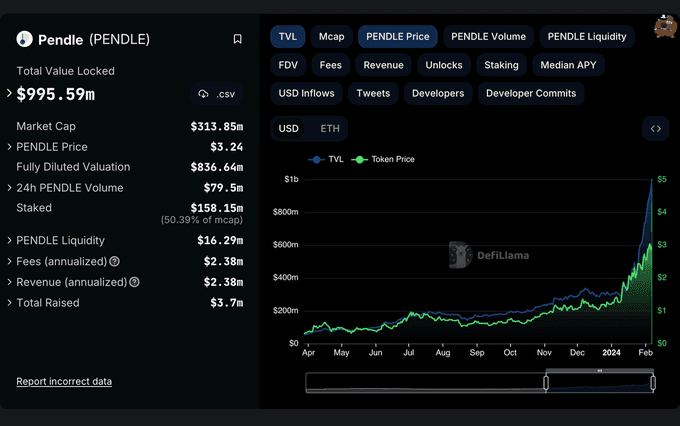

In a landscape continuously shaped by innovations and advancements, layer 2 solutions (L2s) emerge as critical components in the blockchain industry. Analyzing the performance of various L2s, four significant metrics guide our insights: Total Value Locked (TVL), Daily Active Users (DAUs), Daily Transactions, and DEX Volumes.

Diving into the realm of TVL, BuildOnBase takes the lead with $338m, primarily fueled by developments in AerodromeFi and Friendtech. Following closely, ZkSync and StarkNet showcase TVLs of $117m and $41m, reflecting significant engagements with Syncswap DEX and JediSwap respectively.

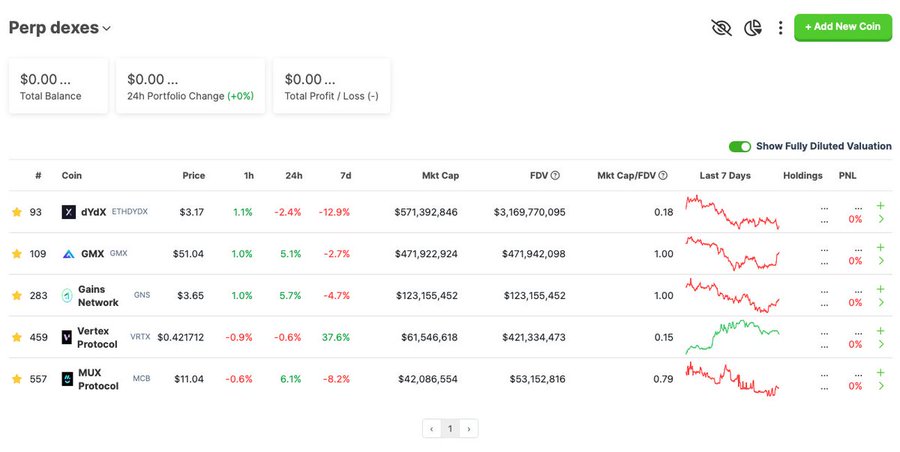

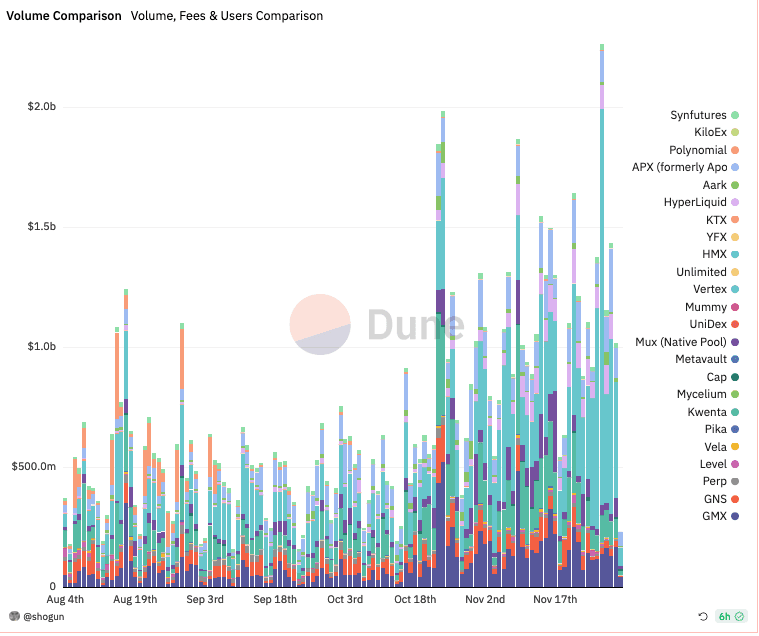

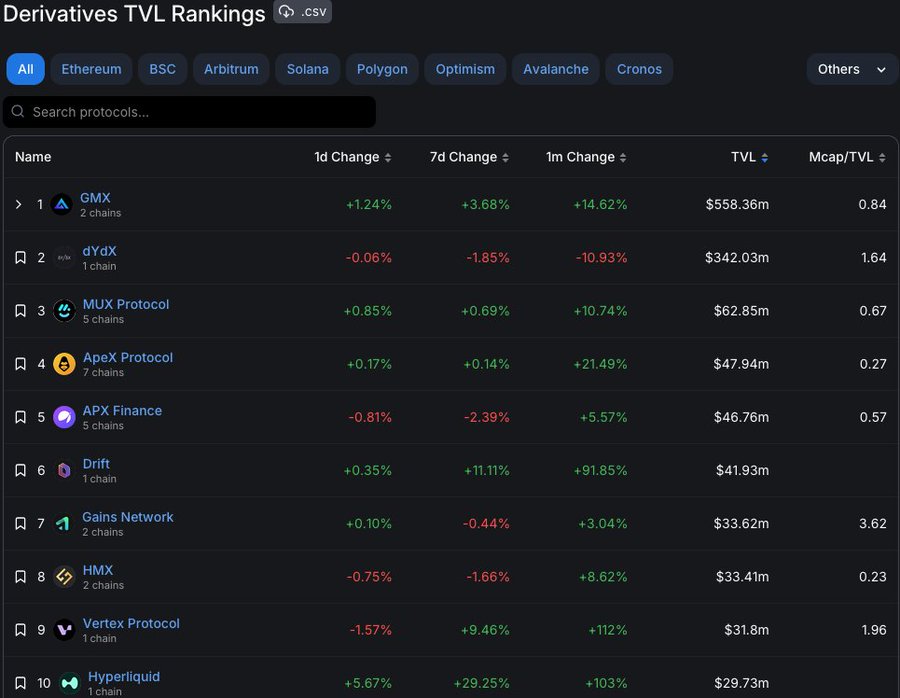

When focusing on DAUs, it is evident that platforms like ZkSync, StarkNet, and Linea are becoming the epicenters for airdrop farming, harboring 246k, 163k, and 36k daily active users respectively. The influx of users to these platforms indicates a prevailing trend for airdrop farming, revealing a necessity for these chains to initiate organic growth through innovative dapps such as GMX.IO for Arbitrum and VelodromeFi for Optimism.

Base stands out, demonstrating organic usage, primarily due to innovative solutions provided by Friendtech. With whispers of a potential airdrop circulating through the industry by Jesse Pollak, there’s an underlying anticipation of substantial growth for Base in the forthcoming months.

Exploring daily transactions, ZkSync, Base, and StarkNet dominate the market with 1m, 633k, and 596k transactions respectively. DEX Volumes further underline the market movements with ZkSync, Base, and StarkNet moving 95m, 17m, and 14m per day.

Gleaning insights from the gathered data, it is apparent that ZkSync is the current favored platform for airdrop farming, whereas Base has succeeded in establishing a substantial user base without the leverage of airdrop incentives, solely by introducing novel dapps. The inference here is clear; a victor in the L2 wars necessitates a balanced concoction of both airdrop incentives and novel dapps, a feat Arbitrum achieved last year by melding GMX with the $ARB airdrop effectively.

As we navigate the ever-evolving marketplace, the debut of new dapps on these chains is something to keep a keen eye on, adjusting success probabilities assertively based on the industry’s dynamic landscape.

A nod of gratitude to the notable contributors such as @0xMughal, @arndxt_xo, @0xTindorr, @rektdiomedes, @defitrader_, @Dynamo_Patrick, @VirtualKenji, @crypto_linn, @2lambro, @_khanhamzah, @AkadoSang, @AngeloDodaro, @CryptoShiro_, @TheDeFISaint, @TheDeFinvestor, @0xnocta, @0xRemiss, @Route2FI, and @saushank_ for their invaluable guidance and insights in maneuvering through the market trends and shifts.

Remember to replace any placeholder link with the actual links to social media profiles or other resources, and adjust as needed to suit your style or add any additional information.

Deciphering L2 Dominance: Metrics and Market Movements

In a landscape continuously shaped by innovations and advancements, layer 2 solutions (L2s) emerge as critical components in the blockchain industry. Analyzing the performance of various L2s, four significant metrics guide our insights: Total Value Locked (TVL), Daily Active Users (DAUs), Daily Transactions, and DEX Volumes.

Diving into the realm of TVL, BuildOnBase takes the lead with $338m, primarily fueled by developments in AerodromeFi and Friendtech. Following closely, ZkSync and StarkNet showcase TVLs of $117m and $41m, reflecting significant engagements with Syncswap DEX and JediSwap respectively.

When focusing on DAUs, it is evident that platforms like ZkSync, StarkNet, and Linea are becoming the epicenters for airdrop farming, harboring 246k, 163k, and 36k daily active users respectively. The influx of users to these platforms indicates a prevailing trend for airdrop farming, revealing a necessity for these chains to initiate organic growth through innovative dapps such as GMX.IO for Arbitrum and VelodromeFi for Optimism.

Base stands out, demonstrating organic usage, primarily due to innovative solutions provided by Friendtech. With whispers of a potential airdrop circulating through the industry by Jesse Pollak, there’s an underlying anticipation of substantial growth for Base in the forthcoming months.

Exploring daily transactions, ZkSync, Base, and StarkNet dominate the market with 1m, 633k, and 596k transactions respectively. DEX Volumes further underline the market movements with ZkSync, Base, and StarkNet moving 95m, 17m, and 14m per day.

Gleaning insights from the gathered data, it is apparent that ZkSync is the current favored platform for airdrop farming, whereas Base has succeeded in establishing a substantial user base without the leverage of airdrop incentives, solely by introducing novel dapps. The inference here is clear; a victor in the L2 wars necessitates a balanced concoction of both airdrop incentives and novel dapps, a feat Arbitrum achieved last year by melding GMX with the $ARB airdrop effectively.

As we navigate the ever-evolving marketplace, the debut of new dapps on these chains is something to keep a keen eye on, adjusting success probabilities assertively based on the industry’s dynamic landscape.

A nod of gratitude to the notable contributors such as @0xMughal, @arndxt_xo, @0xTindorr, @rektdiomedes, @defitrader_, @Dynamo_Patrick, @VirtualKenji, @crypto_linn, @2lambro, @_khanhamzah, @AkadoSang, @AngeloDodaro, @CryptoShiro_, @TheDeFISaint, @TheDeFinvestor, @0xnocta, @0xRemiss, @Route2FI, and @saushank_ for their invaluable guidance and insights in maneuvering through the market trends and shifts.

Remember to replace any placeholder link with the actual links to social media profiles or other resources, and adjust as needed to suit your style or add any additional information.

Continue reading

Continue reading

Deciphering L2 Dominance: Metrics and Market Movements

Sep 26, 2023

Deciphering L2 Dominance: Metrics and Market Movements

Sep 26, 2023