Exploring the Frontiers of Decentralized Finance: Diverse Innovations Unveiled

The decentralized finance sector continues to burgeon with the advent of groundbreaking platforms and protocols that aim to redefine the existing paradigms. In this dynamically evolving ecosystem, solutions like Arrakis Finance, Conic Finance, Lybra, and Matrixdock are emerging as frontrunners in delivering innovative financial mechanisms and tools. Let's delve into the functionalities and prospects of these distinctive innovations in the DeFi space.

Arrakis Finance: A Paradigm Shift in Liquidity Management

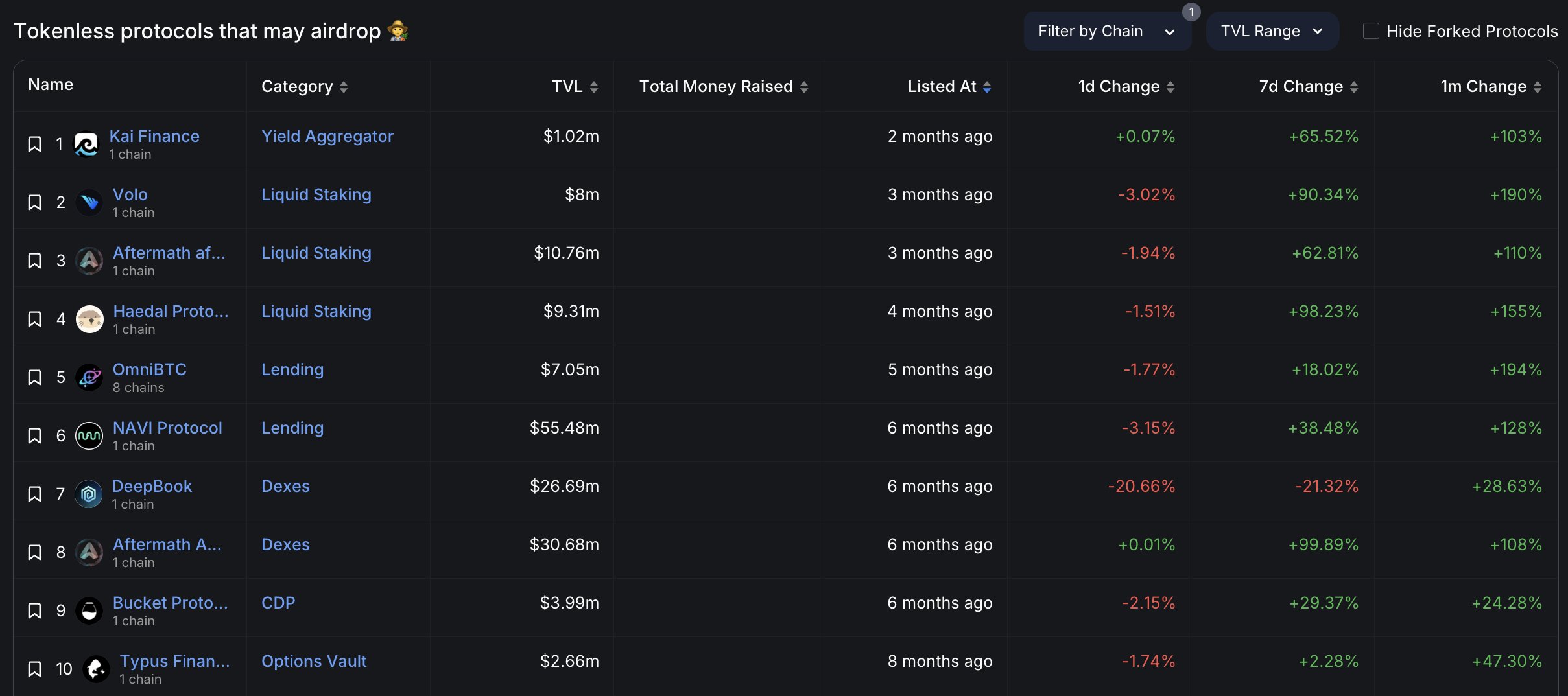

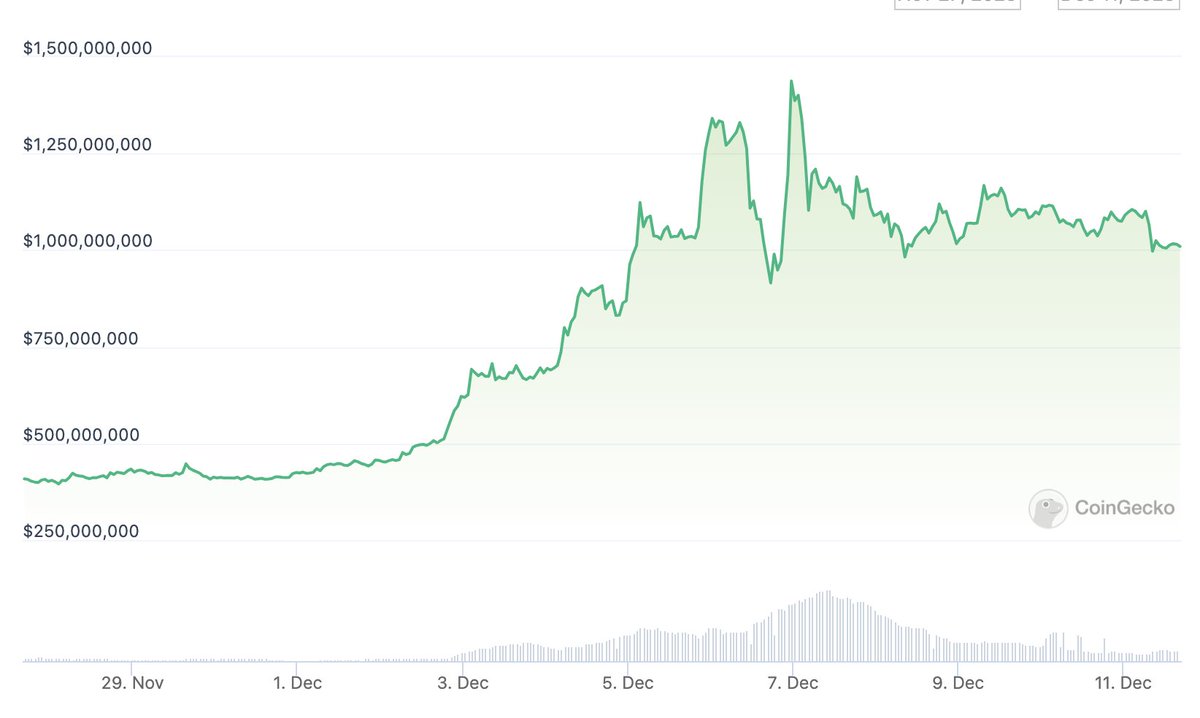

Arrakis Finance is pioneering the realm of automated and trustless liquidity management for Uniswap v3. This revolutionary platform empowers Liquidity Providers (LPs) to automate their strategies, mitigating the stress emanating from relentless position monitoring. The platform has hinted at the potential introduction of the $SPICE token through an airdrop, with the escalating Total Value Locked (TVL) likely being a testament to airdrop farming.

Conic Finance: Diversification Across Multiple Curve Pools

Venturing further, Conic Finance stands out as a specialized platform enabling LPs to diversify their exposure across multiple Curve pools. It allows users to inject liquidity into a Conic Omnipool, which then judiciously allocates the funds across Curve, in alignment with protocol-controlled pool weights. The heightened anticipation surrounding Conic Finance could be attributed to the recent launch of $crvUSD.

Lybra: Harnessing Stablecoin Yield

Lybra has introduced the innovative $eUSD stablecoin, an overcollateralized CDP stablecoin secured by $stETH. Users can lock in $stETH, mint $eUSD, and concurrently earn yields from $stETH. This convergence of stability and yield, offering an 8% yield, sets Lybra apart in the crowded stablecoin market.

Matrixdock STBT Token: On-chain Exposure to U.S. Treasuries

The Matrixdock STBT token enables users to gain exposure to U.S. Treasuries that are maturing within six months and to reverse repurchase agreements collateralized by U.S. Treasury securities. This innovation comes to the fore in higher interest rate environments, signifying the growing traction of on-chain treasuries.

Conclusion: Diverse Innovations Reshaping DeFi

The seamless amalgamation of these diversified innovations reflects the incessant progress within the DeFi sector. Whether it's trustless liquidity management, diversified pool exposure, yield-generating stablecoins, or on-chain treasuries, these platforms are pushing the boundaries and expanding the horizons of what's conceivable in decentralized finance.

These insights surfaced thanks to @rektdiomedes and were featured in the @thedailydegenhq newsletter. For more nuanced perspectives and information on the burgeoning world of DeFi, follow @Prithvir12 and stay attuned to the relentless evolution unraveling in the financial ecosystems.

Exploring the Frontiers of Decentralized Finance: Diverse Innovations Unveiled

The decentralized finance sector continues to burgeon with the advent of groundbreaking platforms and protocols that aim to redefine the existing paradigms. In this dynamically evolving ecosystem, solutions like Arrakis Finance, Conic Finance, Lybra, and Matrixdock are emerging as frontrunners in delivering innovative financial mechanisms and tools. Let's delve into the functionalities and prospects of these distinctive innovations in the DeFi space.

Arrakis Finance: A Paradigm Shift in Liquidity Management

Arrakis Finance is pioneering the realm of automated and trustless liquidity management for Uniswap v3. This revolutionary platform empowers Liquidity Providers (LPs) to automate their strategies, mitigating the stress emanating from relentless position monitoring. The platform has hinted at the potential introduction of the $SPICE token through an airdrop, with the escalating Total Value Locked (TVL) likely being a testament to airdrop farming.

Conic Finance: Diversification Across Multiple Curve Pools

Venturing further, Conic Finance stands out as a specialized platform enabling LPs to diversify their exposure across multiple Curve pools. It allows users to inject liquidity into a Conic Omnipool, which then judiciously allocates the funds across Curve, in alignment with protocol-controlled pool weights. The heightened anticipation surrounding Conic Finance could be attributed to the recent launch of $crvUSD.

Lybra: Harnessing Stablecoin Yield

Lybra has introduced the innovative $eUSD stablecoin, an overcollateralized CDP stablecoin secured by $stETH. Users can lock in $stETH, mint $eUSD, and concurrently earn yields from $stETH. This convergence of stability and yield, offering an 8% yield, sets Lybra apart in the crowded stablecoin market.

Matrixdock STBT Token: On-chain Exposure to U.S. Treasuries

The Matrixdock STBT token enables users to gain exposure to U.S. Treasuries that are maturing within six months and to reverse repurchase agreements collateralized by U.S. Treasury securities. This innovation comes to the fore in higher interest rate environments, signifying the growing traction of on-chain treasuries.

Conclusion: Diverse Innovations Reshaping DeFi

The seamless amalgamation of these diversified innovations reflects the incessant progress within the DeFi sector. Whether it's trustless liquidity management, diversified pool exposure, yield-generating stablecoins, or on-chain treasuries, these platforms are pushing the boundaries and expanding the horizons of what's conceivable in decentralized finance.

These insights surfaced thanks to @rektdiomedes and were featured in the @thedailydegenhq newsletter. For more nuanced perspectives and information on the burgeoning world of DeFi, follow @Prithvir12 and stay attuned to the relentless evolution unraveling in the financial ecosystems.

Continue reading

Continue reading

Exploring the Frontiers of Decentralized Finance: Diverse Innovations Unveiled

May 25, 2023

Exploring the Frontiers of Decentralized Finance: Diverse Innovations Unveiled

May 25, 2023